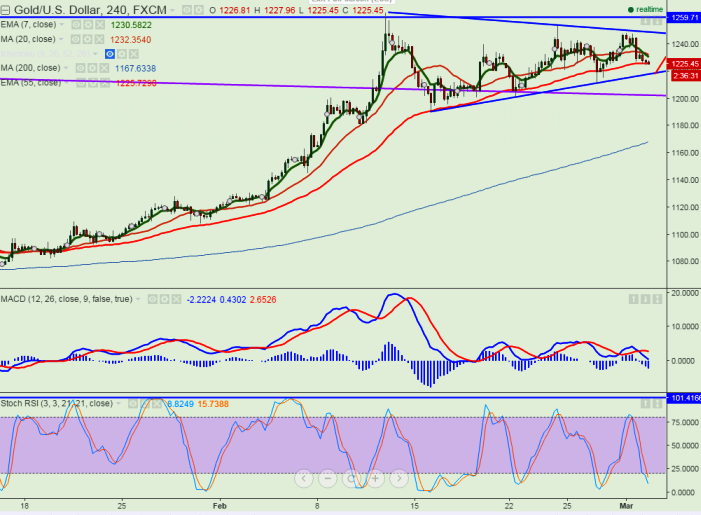

- Major support - $1217 (trend line joining $1190 and $1201.80)

- Major resistance -$1249 (trend line joining $1263 and $1253)

- The commodity has retreated after making a high of $1248 yesterday. It is currently trading around $1225.

- Short term trend is slightly bullish as long as support $1210 holds.

- On the higher side minor resistance is around $1232 and any break above targets $1240/$1251.

- Any break below major support $1217 will drag the commodity to next level $1200/$1180.

- Short term bearish invalidation only below $1180.

It is good to buy at dips around 1217-$1220 with SL around $1210 for the TP of $1240/$1251