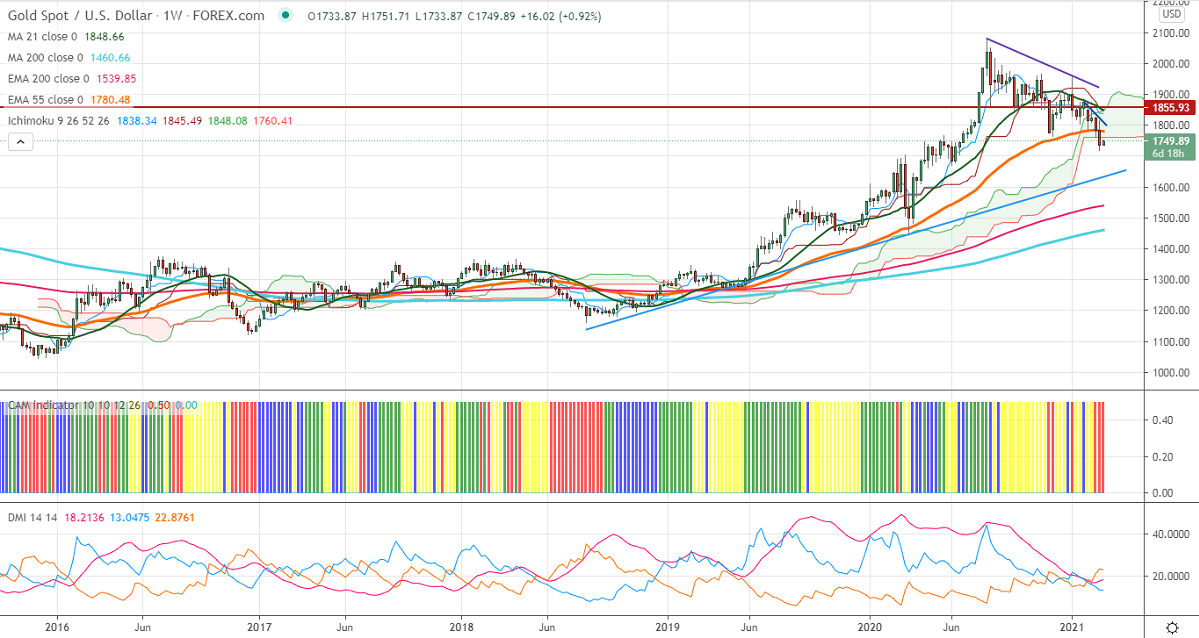

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1838

Kijun-Sen- $1854

Gold was one the worst performer in the previous week and lost more than $100 and surging US bond yield. The US 10—year yield hits year high at 1.56% in hopes of more fiscal stimulus to counter pandemic. The US dollar index has shown a nice recovery of 100 pips from a minor bottom 89.68.

Economic data:

In the semi-annual testimony, Powell stated that the decline in the number of coronavirus cases and hospitalization and ongoing vaccinations has increased hopes of the normal condition later this year. The index of consumer confidence rose to a 3-month high at 91.3 in Feb better than the forecast of 90. US Q4 GDP surged to 4.1% compared to a forecast of 4.2%. The number of people who have filed for unemployment benefits declined to 730k in the week ended Feb 20th vs an estimate of 828k.

Technical:

It is facing strong support at $1700, violation below targets $1700/$1637. On the higher side, near-term resistance is around $1760, any indicative break above that level will take till $1779/$1800.

It is good to sell on rallies around $1758-60 with SL around $1781 for the TP of $1700.