Gold pared some of its gains after strong US jobs data. It hit an intraday high of $3269 yesterday and is currently trading around $3252.11.

The US April 2025 Non-Farm Employment Change registered a gain of 177,000 jobs, which was better than the 130,000-145,000 consensus, although lower than the revised March figure of 185,000. The unemployment rate remained at 4.2%, while average hourly pay increased 0.3% month-on-month. This better-than-expected growth in jobs alleviates near-term pressure on the Federal Reserve to lower rates next month, even though the labor market indicates signs of decelerating relative to last year.

Rate Cut Expectations on the Rise

According to the CME Fed Watch tool, the chances of rate pause in June 18th 2025 meeting have increased to 56.40% from 36.70% a week ago.

Technical Analysis: Key Levels and Trading Strategy

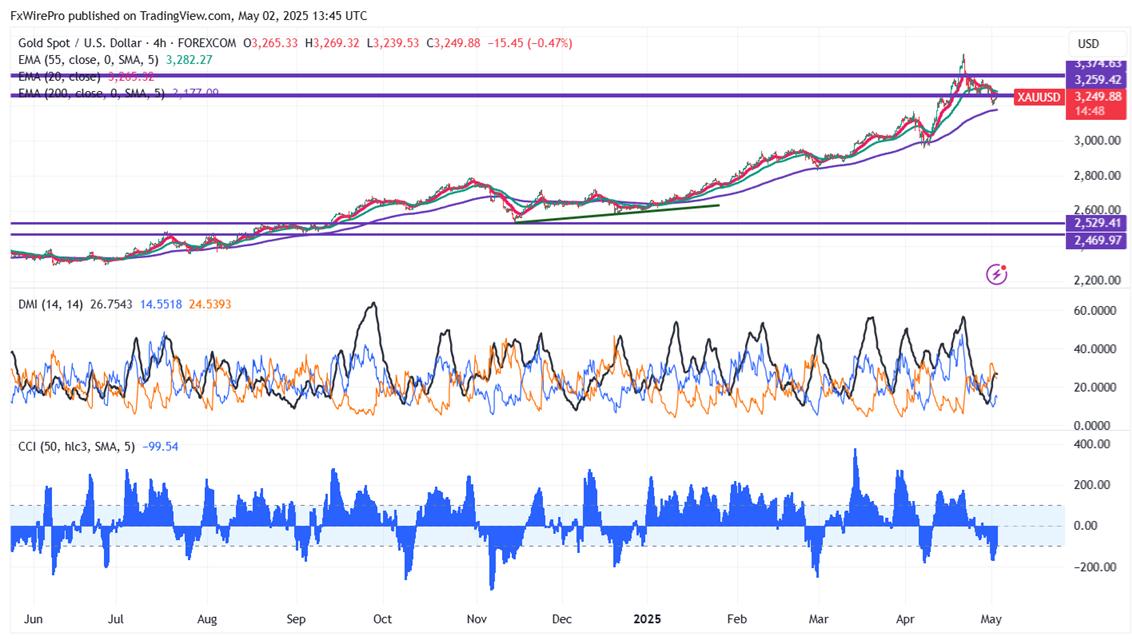

Gold prices are holding below short term moving average 34 EMA and 55 EMA and above long-term moving averages (200 EMA) in the 4-hour chart. Immediate support is at $3200 and a break below this level will drag the yellow metal to $3168/$3100/$3000. The near-term resistance is at $3251 with potential price targets at $3262/$3270/$3282/$3300.

It is good to sell on rallies around $3248-50 with a stop-loss at $3270 for a target price of $3167.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate