Whatever be the driving forces, whether it is mounting geopolitical issues or global economic slowdown or anything else, the underlying price of any asset class is a function of demand/supply equation ultimately.

While we have already stated that the demand for bullion space appears to be down-casted in Asian regions on account of economic slowdown, natural calamities in countries like India and most importantly, rising prices have all hampered the consumer buying sentiments, even if attractive discount offers is luring buying interests on the eve of the major festival season in the region.

Bullion prices in India (Gold & Silver futures), the one of the largest bullion consumers after China, is trading at around Rs.38,464/10 grams at MCX (while articulating), easing -0.09% from previous close, while silver is trading at Rs.45,938 level for December 2019 delivery.

In our recent post, we raised a cause of concern for Gold’s (XAUUSD) rallies in the short run. Accordingly, the yellow metal prices seemed little edgy, the price dipped below $1,500 an ounce before it staged for the prospects of 6-1/2 years highs.

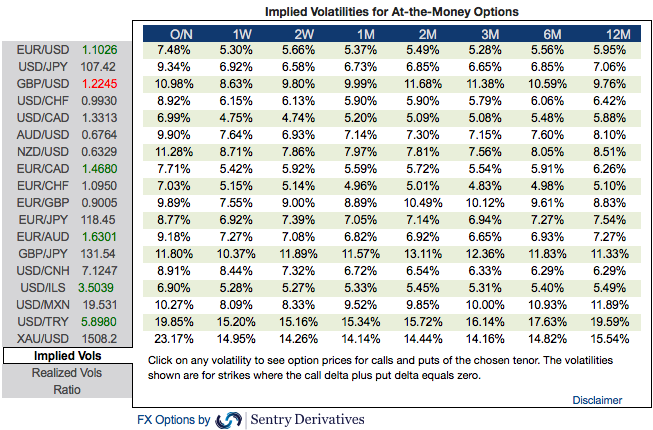

Gold 1M ATM vol rose slightly over the past week as the spot price also surged considerably back up above $1,500 levels. In a recent report, we used JPM’s regime-based model (Hidden Markov Model) to analyse the dynamics of GVZ, (i.e. the ‘Gold VIX’ Index).

This index is calculated using the same methodology as the VIX but uses the ETF GLD instead of the S&P 500.

Where we observe that when imposing a 3-regime model on the gold VIX, the 3-regimes (which we call low, medium, and high) that the model produces have means of 12, 17, and 27, respectively. Furthermore, the boundaries are 14, and 21 and the model spends roughly 28%, 44%, and 28% of the time in each of the regimes.

Currently the GVZ is at 15.26 and since we find that the GVZ level tends to get ‘stuck’ in its regimes, our model expects that it is more likely for GVZ to tend towards it current regime’s mean of 17 as opposed to falling below 14 into the lower regime. The previous analysis is one reason we prefer to go long on gold vol.

Most importantly, positively skewed 3m IVs of XAUUSD indicate upside risks, bids for OTM calls reveals that intensified buying momentum in the underlying spot prices. In addition, the positive risk reversal numbers also substantiate the same hedging sentiments.

Another reason is that the gold spot price projection which points towards a further 18% appreciation by mid-2020. The high spot-vol correlation should bring about a large increase in gold vol, see the following report for more details.

Hence, we advocate adding longs in 9M 25D at the money gold call options at 15.54 vols, indicatively.

Alternatively, on hedging grounds, we advocated long positions in August month’s CME gold contracts. We now like to re-initiate the same strategy by adding longs in CME Futures contracts for December’19 delivery as we could foresee more upside risks amid global financial crisis.

Buying interests are mounting on safe-haven sentiments amid global slowdown which is still imminent. Courtesy: Sentrix, JPM & Saxobank

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts