FxWirePro: Gold Weekly Outlook

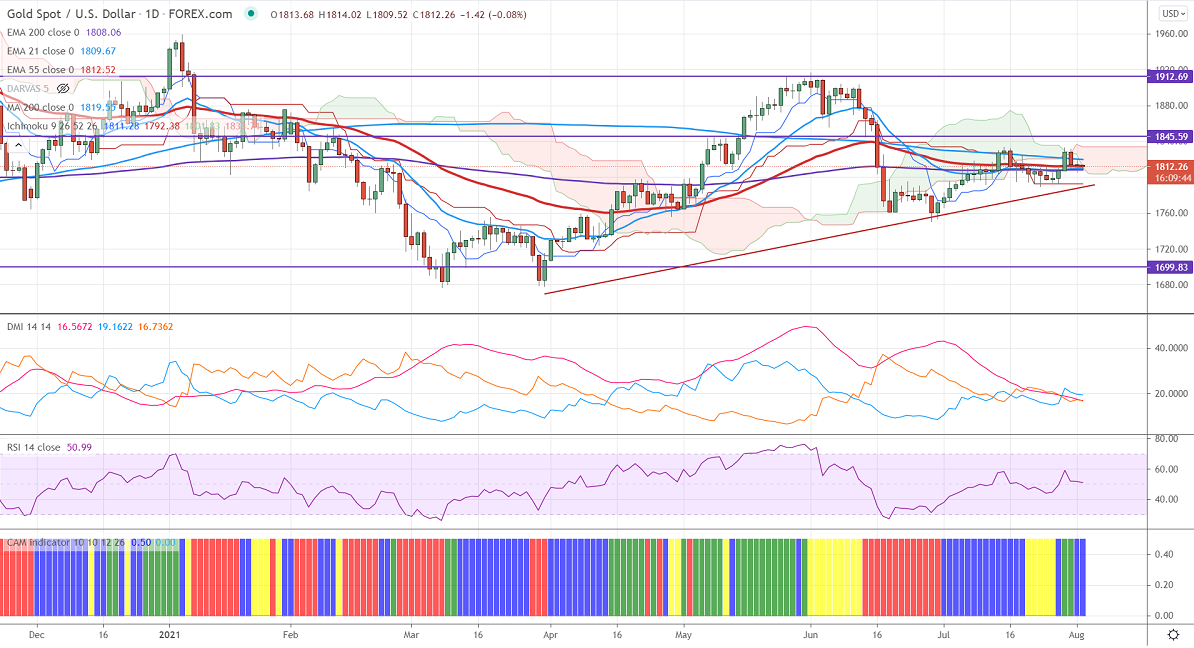

Ichimoku analysis (Daily chart)

Tenken-Sen- $1811.26

Kijun-Sen- $1792.38

Gold is trading in a narrow range after hitting a high of $1831. The declining bond yields are preventing the yellow metal from further decline. The US 10-year yield slipped below 1.15%, the lowest level since Feb 2021. The US dollar index showed minor weakness after US ISM data. It came at 59.5 in Jul compared to a forecast of 60.8. The yellow metal hits an intraday low of $1809.71 and is currently trading around $1812.20. The spread of delta variants across has increased demand fr safe-haven assets.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- weak (positive for gold)

Technical:

It is facing strong support at $1790 violation below targets $1780/$1765. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1821 and a convincing break above will take the yellow metal $1835/$1860/$1900 is possible.

It is good to buy on dips around $1790-91 with SL around $1778 for TP of $1850