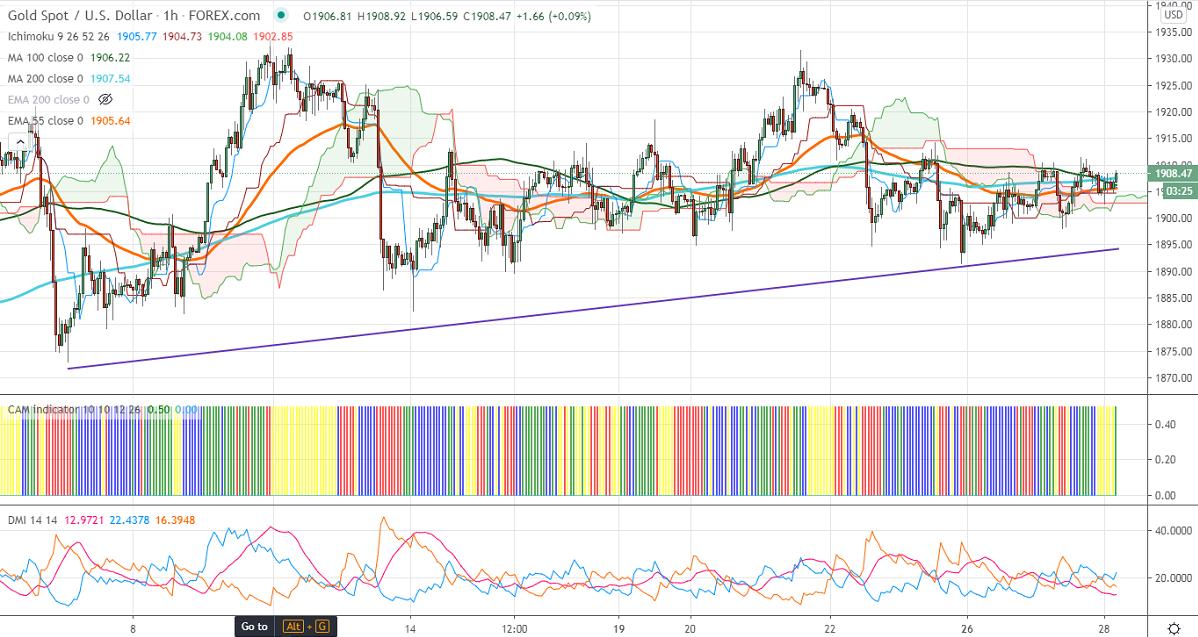

Ichimoku analysis (1-Hour chart)

Tenken-Sen- $1905.77

Kijun-Sen- $1904.73

Gold is holding above $1900 on rising Coronavirus cases. The strength in the dollar is putting pressure on yellow metal at higher levels. The United States saw a record number of cases for the second consecutive days and the total number of death crossed two lakhs. The dollar index is struggling to close above 93.10 (55-4H EMA). Any violation above will take the index till 93.50/94. The 10-year yield declined more than 10% after hitting a 4-month high at 0.872%.

Economic data:

U.S durable goods orders rose by 1.9% in September compared to forecast by 0.5%. The conference board Consumer confidence came at 100.9 vs an estimate of 102.10.

Technical:

In the 4-hour chart, Gold is facing strong resistance near 200-MA at $1910. Any break above will take the pair till $1921/$1933. On the lower side, near term intraday support is around $1880 and any indicative break below that level will take till $1860/$1848.

It is good to buy on dips around $1880 with SL around $1868 for the TP of $1920/$1933.