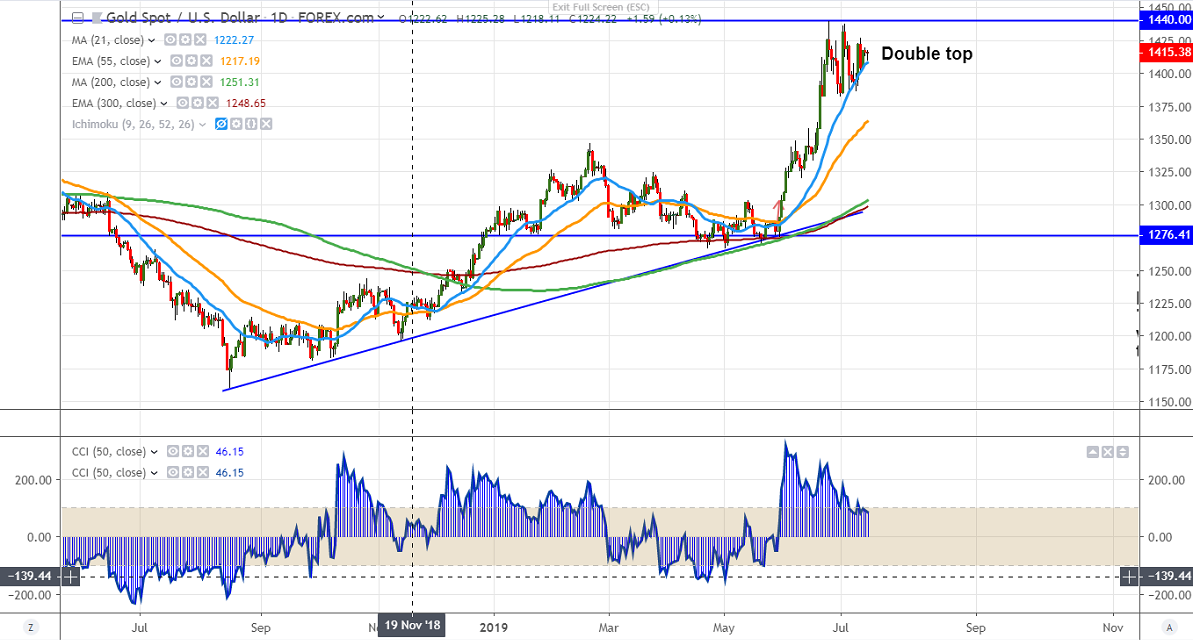

Gold is trading in a narrow range between $1437 and $1385 for the past 5 trading days. The yellow metal formed a triple top ($1440,$1437 and $1427). US 10 year yield trades higher for the 3rd consecutive week and jumped more than 11% from low of 1.93%. According to the CME Fed Watch tool, there is a 74.4% probability of rate cut in Jul and 25.6% chance of rate cut of 50 bpbs.

On the flip side, near term support is around $1400 and any break below will drag the yellow metal to the next level till $1390/$1380. Major weakness only below $1380.

The near term minor resistance is around $1428 and any break above will take the yellow metal to $1440. Any major bullish continuation only above $1440. Any break above targets $1465.

It is good to sell on rallies around $1415-17 with SL around $1427 for the TP of $1380.