The precious metal (gold) price gains constantly from the last couple of days, especially after the lows of $1,455 levels. But to begin this week, these price gains have been pared with profit booking sentiments. Currently, trading well above $1,700 levels.

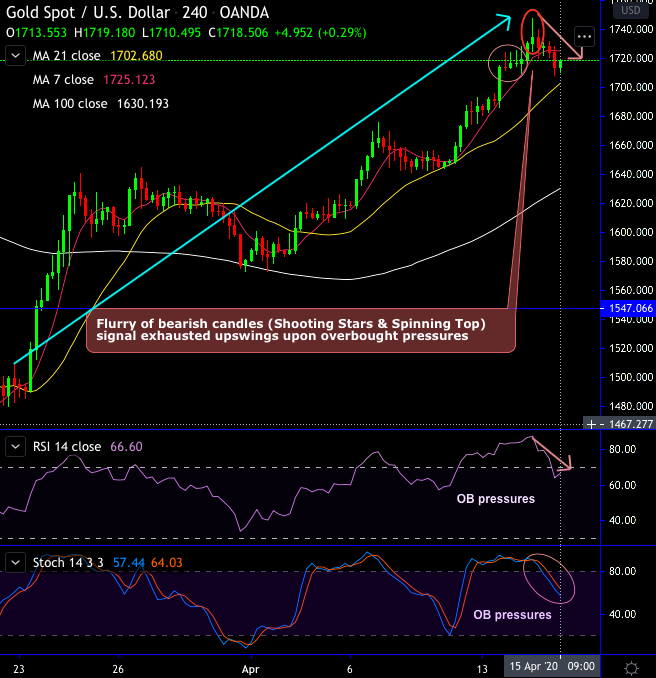

Technically, XAUUSD (Gold) price chart forms back-to-back shooting star and gravestone doji at peaks of rallies. These bearish pattern candles coupled with downward convergence of leading oscillators (RSI & Stochastic curves) signal overbought pressures (refer oval shaped area in the daily chart). Thereby, the minor uptrend has appeared to be exhausted and the current price have slid below 7-DMAs at this juncture.

Prior to which, as stated before in our recent post, bulls bounce back especially after testing the strong support at $1,445 - $1,455 levels as both leading and lagging are in sync with the minor uptrend.

On a broader perspective, Bulls have broken-out the stiff resistances of 1,707.89 level (i.e. 88.6% Fibonacci level of December 2015 lows of (i.e. 1044.62) and August 2011 highs of (1922.88) as hammer pops-up at the saucer base, the current prices spike off well above EMAs convincingly with bullish crossovers as the major uptrend is most likely to prolong through saucer pattern upon bullish EMA & MACD crossovers, while both the leading oscillators substantiate the buying sentiments on this timeframe as well.

Trade tips:

At spot reference: $1,718 level, on trading grounds, boundary options trading strategy with upper strikes at $1,725.130 and lower strikes at $1,702 levels. One can achieve certain yields as long as the underlying spot FX remains between these two strikes on the expiration.

Alternatively, on hedging grounds, we advocated long positions CME gold contracts of April’2020 delivery, we now upheld the same strategy by rolling over these contracts for May’20 deliveries as we could foresee more upside risks and intensified buying interests on safe-haven sentiments amid coronavirus pandemic and the global financial crisis.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?