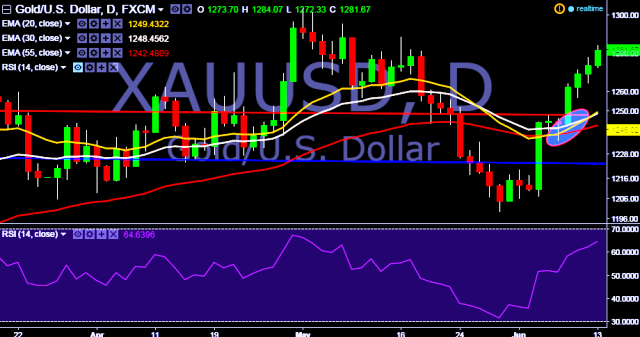

- XAU/USD is currently trading around $1281 marks.

- It made intraday high at $1284 and low at $1272 marks.

- Intraday bias remains bullish till the time pair holds key support at $1264 marks.

- A sustained break below $1262 will take the parity back below $1248 marks.

- Alternatively, a daily close above $12785 is required to drag the parity higher towards key resistances around $1295, $1303 and $1316 marks respectively.

- Key support levels are seen at $1264, $1262, $1255, $1248 and $1232 marks respectively.

- Markets are getting more cautious ahead of the FOMC meeting on this Wednesday where new economic projections will be released.

We prefer to take long position in XAU/USD only above $1,282 with stop loss at 1,264 and target of $1,303/ $1,310/$1,316 marks respectively.