The dollar can happily ignore the US inflation data for July due for publication today, as it will not provide any significant news. The overall rate remains just below 3% due to energy prices and is likely to have peaked now. Core inflation might only record 2.2% today rather than the expected 2.3%. That is not a drama though as it nonetheless remains above the inflation target. The data fits into the picture of a Fed continuing with its rate cycle for now.

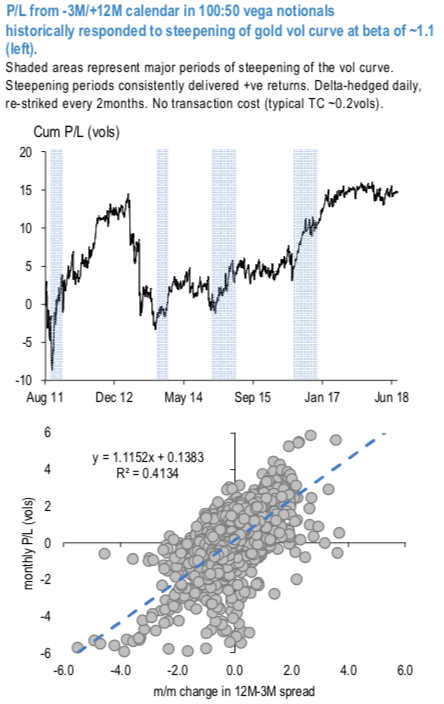

While the historical performance of XAUUSD vol calendars (refer above chart) exhibits a constantly good track record during vol curve steepening episodes, with 1.1 beta of returns to vol pts of steepening. 12M-3M should widen by about 1.1vols in order to mean-revert to its 1Y average (from the currently 2 sigma too narrow gap); a rough assessment of the mean- reversion speed of the vol spread places its half-life at around 2.5 weeks which, being well below the maturity of the short leg of the spread, should give enough time for the term-structure dislocation to correct.

Moreover, at current market the structure is showing 2 vols of vol carry from the short front-end straddle. Accounting for both P/L components (vol curve and implied-realized gap) in a multivariate historical regression we estimate >1.6 vols of potential gain, while 1Y @10.7 vols and at a historical low should limit the downside.

With the latest positive turn in trade developments, one potential near term risk to the short front vol leg that still remains is the Friday GDP print. Still, given the tight risk-reversals, implying a spot/vol correlation near zero (at 7%), large moves in the spot should not overly impact the front-end of the curve and trigger a further tightening of the 1Y-1M spread.

To summarize, with the current gold surface dislocation mostly concerning the elevated front end vols and a sizeable implied-realized gap we overweight the short vol front leg:

Sell 3M @9.45 choice vs buy 1Y @10.3/10.65 indic XAUUSD straddles in 100:50 vega notionals, keep delta-hedged. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD is inching at 33 (which is mildly bullish), while articulating (at 12:17 GMT). For more details on the index, please refer below weblink:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts