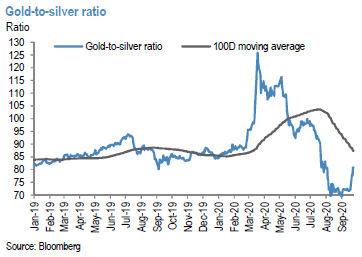

Gold price has seen a volatile session of late, but is currently sitting 0.4% higher at USD1,897/oz levels. Precious metals regained some sheen as the dollar weakened. Increased optimism over fresh stimulus in the US and Europe is pushing the gold price towards USD1,900/oz. Although, uncertainty has been lingering ahead of the US election favours the safe haven investment demand of gold, the predominantly dollar-driven price rout in precious metals this week left gold prices nearly 5% lower on the week at $1,860/oz while silver prices fell close to 16% wow back down to below $23/oz as the gold-to-silver ratio shot higher from the low 70s to the low 80s (refer 1st chart). The negative USD vs precious metals relationship, which was pretty consistent pre-2019, has only really re-established itself recently (refer 2nd chart). The relationship really started to break down in the middle of 2019 as gold took bullish cues from the Fed transitioning from hiking to cutting interest rates, largely ignoring a strengthening USD throughout the year.

Nevertheless, after marking positive territory as recently as late July, the rolling 63-day correlation between the BCOM Precious Metals sub-index (Bloomberg commodity index) and the trade-weighted USD has (negatively) strengthened once again, falling towards nearly -0.5 this week.

The negative correlation between precious yellow metal price and the dollar appears to be reinforcing after dislocation in 2019. Even when USD is not acting as a consistent primary price driver (i.e., over the last few years), we do see some evidence to suggest that sharp dollar moves have still been influential to gold, prompting expansions/contractions in gold’s premium to US real yields. Courtesy: JPM

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025