European Central Bank upgrades GDP outlook and removes easing bias.

The first round of French assembly election strengthens Macron’s hand.

Last week it was the ECB and the UK elections, this week it is the Fed, BoE, and BoJ: major events for the FX market are on the agenda. An FX analyst writing the commentary at the start of the week would find it easy to fuel hope (or fear, depending on one’s perspective) of dramatic exchange rate moves in one or the other direction.

The euro avoided the worst scenario after the French presidential election when anti-EU risk sentiment threatened to force the currency below its two-year range.

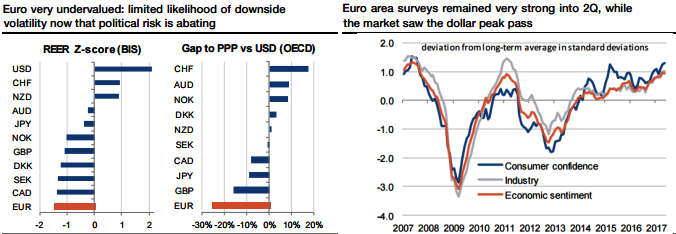

Now, the bearish case is definitely losing ground, and thanks to the structural surplus of the euro area and lasting undervaluation of the single currency (PPP and REER – refer above graph), EURUSD should remain above parity.

Now that the market perceives that political risk has massively receded, its focus will return to the ECB. The monetary divergence should morph, as the Fed has already started to tighten and the ECB could be prompted to smooth its forward guidance and taper QE as soon as reflation signs are confirmed. Meanwhile, the dollar is losing ground.

The EURUSD range of 1.05 - 1.16 corresponded to the period of ECB asset purchases, which are keeping the euro under pressure. Our economists expect a compromise in September, seeing an extended programme but at a reduced monthly pace starting in 4Q’17.

With the reversal of QE, tapering is probably one of the main factors that could lift the euro. As economic sentiment is becoming much brighter (refer above graph), the new nature of the monetary divergence could be among the factors triggering a volatile euro bullish wave.

Since January 2015 EURUSD has not traded above 1,15 or below 1.05 on a sustainable basis, since the Brexit referendum EURGBP has not eased below 0.8350, nor has it traded above 0.8770 since November – with the exception of short, erratic spikes. And this phenomenon is by no means restricted to G10 exchange rates.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand