The main risks events are now in the euro zone (ECB in September, Italian referendum, immigration tensions).

A constitutional referendum is planned to be held in Italy on Sunday 4 December 2016. Voters are to be asked whether they approve of amending the Italian constitution to transform the senate of the republic into a "Senate of regions" composed of 100 senators mainly made up of regional councilors and mayors. Italians seem to have their say on Prime Minister Matteo Renzi and the economy isn’t doing him any favors.

Technically, EURAUD has broken the support at 1.4425 levels that was stuck inside a 1.4425-1.4905 sideways range from last three months, with significant event risk this week from the ECB.

The meeting on Thursday would be closely watched for any discussions over a shift to fiscal policy (which would be EURAUD depressive).

A shift in ECB policy is highly unlikely, but the post-meeting press conference will provide Draghi another means of calling for structural reforms and the use of fiscal space to step up to the policy plate.

On long-term perspectives, the security, and political risks should weigh on the EUR: the Italian senate reform referendum this month, Italian and Austrian elections in December, and Dutch, French and German elections in 2017.

There also remains the prospect of further easing measures from the ECB (for example a formal extension of QE beyond March 2017).

OTC Outlook and Hedging Strategy:

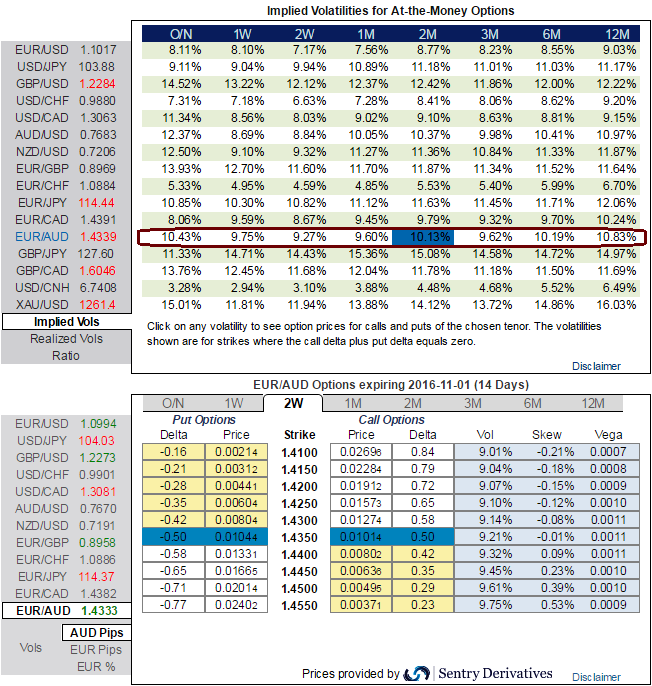

As you can probably guess from the negatively skewed IVs during 2w tenors lures option writers’ opportunities. An option writer wants IV to shrink away so that the premium would also drops accordingly. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Subsequently, 2m implied volatilities are considerably spiking on higher side that is most likely to favor vega puts in the robust downtrend.

As a result, we believe in jacking up in long leg of the below option strategy:

Initiate longs of 2 lots of 2m at the money vega put options, simultaneously, short 1 lot of (1%) in the money put of 2w expiry with positive theta. It is advisable to prefer European style options.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022