Seasonally vol soft April turned out to be anything but soft. The US yield curve’s return to the forefront first in the form of concerns about yield curve flattening and inversion and later on in form of anticipation of the US 10-year breaching the 3% level, a line in the sand. The focus on the yield curve reverberated through FX markets pushing USD vols and JPY cross-vols sharply 0.4-0.5 vols higher and sparking a +1.8% broad dollar rally and interest in catch-up bullish USD option prospects.

Overall, over the course of last few days, USD TWI has broken out of the two-month range and has retraced more than half of the January/February drop.

The down move in EURUSD will not correspond to a free fall but a bungee jump. Following the sharp downswing in EURUSD since mid-April, a correction towards 1.20 was normal anyway. But above all, this is a dollar correction - i.e. the bungee in the jump. As a result, we would be very cautious to bet on the euro again and to consider levels below 1.19 as buying levels in the hope that the uptrend in EURUSD will continue.

The direction is definitely a different one! Fundamentally nothing has changed: the Fed continues its rate hike cycle and yields in the US continue to rise happily (10-year yields well above 3% again) while the ECB, on the other hand, will remain expansionary for some time yet, a fact that ECB President Mario Draghi is likely to confirm today.

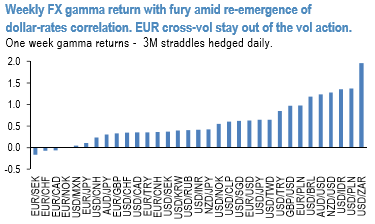

FX gamma returned with fury (refer 1st chart) amid re-emergence of dollar-rates correlation and the subsequent FX spot jitters. Predictably, gamma returns concentrated within the USD vols with the high beta heavyweights leading the way.

Admittedly, a big chunk of that gamma P/L came from front vols repricing as fears from dollar unwinds spread. Amid the market focus on the US yields, EUR cross-vol mostly stayed out of the way of this week vol action.

With technical drivers firmly in the driver’s seat, via the US rates->FX spot->FX vol channel, we turn to assessing current VXY fair value relative to trailing realized USD vols and swaptions instead of taking our more typical approach of regressing VXY on cyclical factors.

Tracking the regression residual, the 2nd chart indicates VXY-Global to be only marginally cheap (0.5vols) relative to those technical factors based fair value. The tight relationship also implies that absent the USD spot vol and US rates vol drivers, VXY is likely to consolidate.

Consequently, we remain reserved about the longevity of the ongoing rates-spot-vol bout but do understand the need and discuss below a few options for hedging of the ongoing market.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data