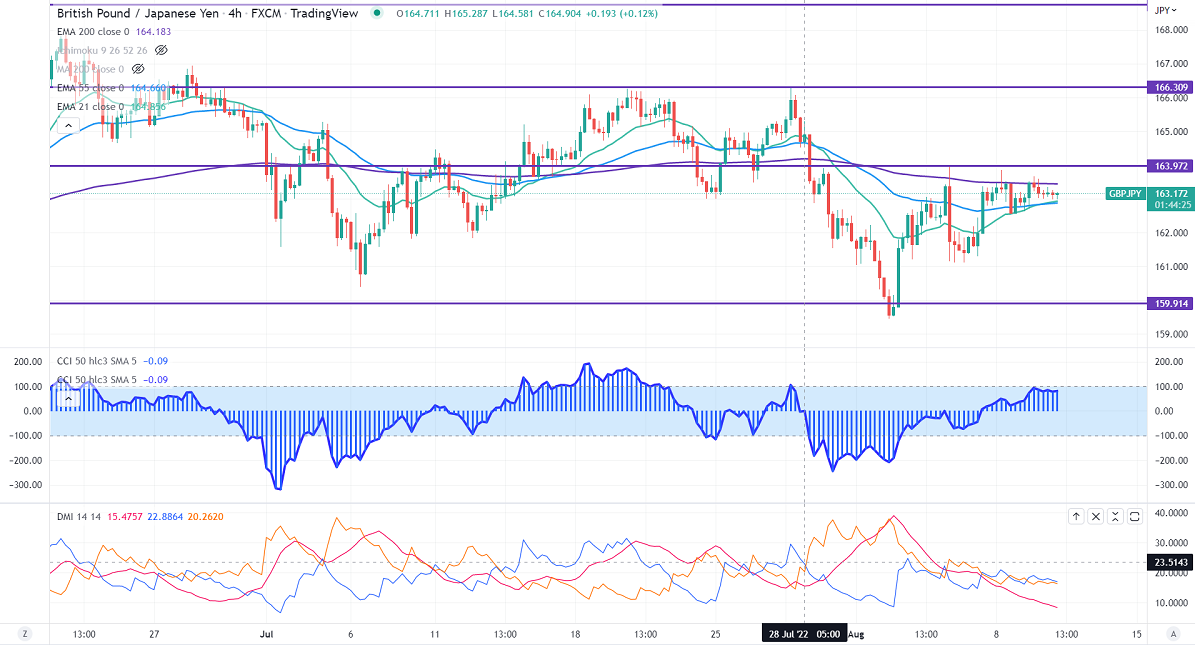

GBPJPY trades flat ahead of US CPI data. The minor profit booking in pound sterling puts pressure on the pair at higher levels. The Brexit pessimism and political uncertainty cap cable upside. USDJPY pared some of its gains made the previous week. Technically in the 4-hour chart, the pair is holding above short-term 21-EMA, above 55 EMA, and below long-term 200 EMA (163.45). Any violation above 164 will take the pair to the next level 165.25/166.20. GBPJPY hits an intraday high of 163.84 and is currently trading around 163.16.

The near-term support is around 163, a breach below targets 161.80/161.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- Neutral

It is good to buy above 164 with SL around 163 for TP of 166.25.

Or

Good to sell below 163 with SL around 164 for TP of 161.