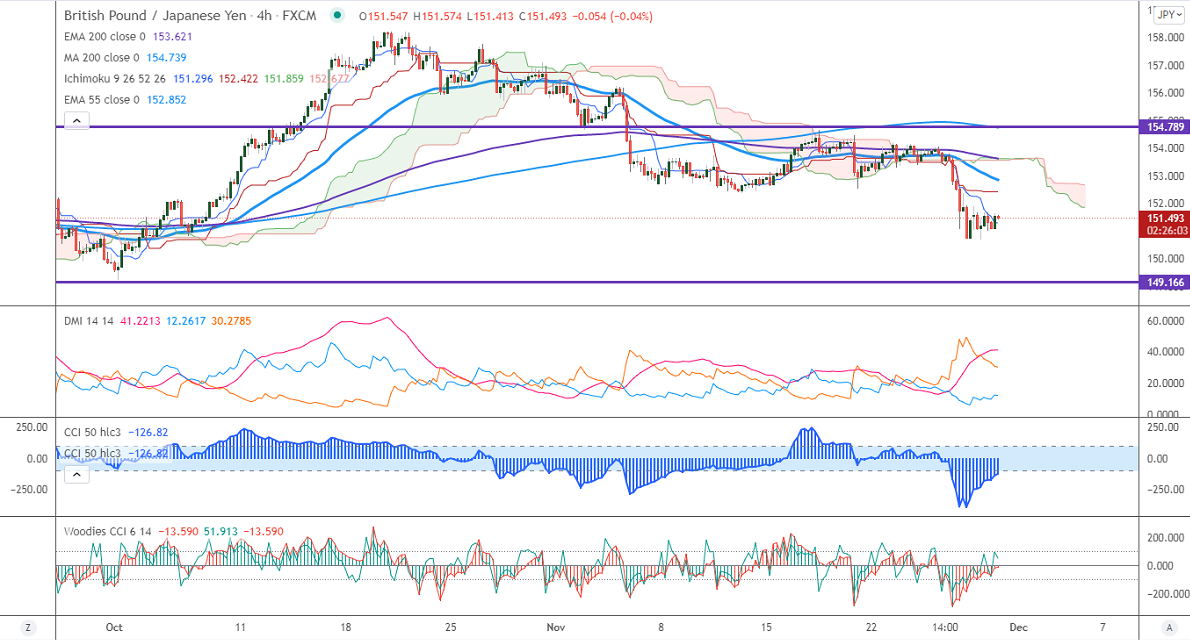

Major Intraday resistance -152

Intraday support- 150.70

GBPJPY is consolidating after a sell-off on Friday. The pair lost nearly 300 pips as Yen gained due to Omicron's fears. The minor pullback in pound sterling from an 11-month low against the USD is supporting the pair at lower levels. The recovery in GBPUSD will be limited due to new virus risk. Any jump above 1.3370 confirms intraday bullishness. The intraday trend of GBPJPY is bearish as long as resistance 152.60 holds. It hits a high of 151.688 yesterday and is currently trading around 151.488.

USDJPY- Analysis

The pair pared some of its gain made today despite a decline in US treasury yield. Any breach below 113 confirms a bearish continuation.

CCI Analysis-

The CCI (50) and Woodies CCI are holding below zero level in the 4- hour chart. It confirms a major bearish trend.

Technical:

The immediate resistance is around 152, any break above targets 152.50/153/153.45/154/154.75. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 150.70. Any indicative violation below targets 150/149/148.

Indicator (4-Hour chart)

Directional movement index –Bearish

It is good to sell on rallies around 151.55-60 with SL around 152.55 for a TP of 149.9.