As stated in our recent post, we are sensing the copy-cat range process of the summer range we have been looking for in the medium term perspectives. This has actually become a range within that range, with 1.2300 – 1.2510 the inner range, while 1.2080 – 1.2675 is the current outer range. 1.28-1.31 is major resistance for us above there. The cross is the main driver at this stage.

Long term, we see a greater risk of another downside test, but that should complete the bear cycle we have been in from the 2007 highs at 2.1160. A major base is then expected to develop for an ultra-long term move towards 1.55-1.70 region.

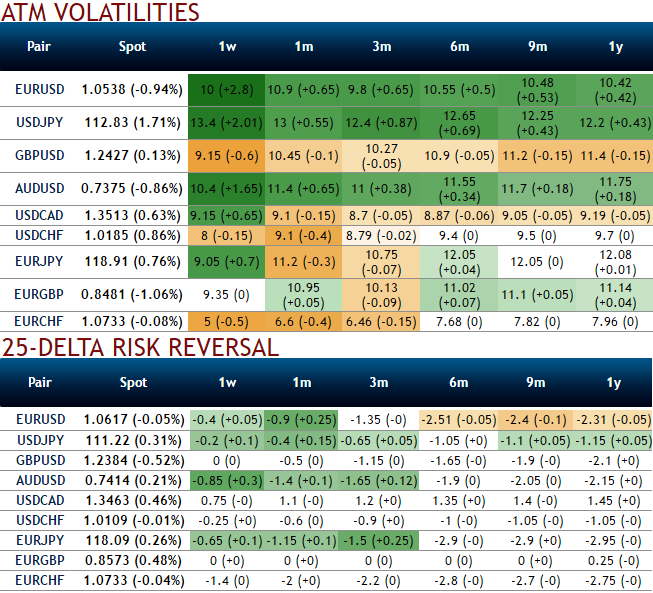

OTC Updates and Option Strategies (GBP/USD):

Buy GBP/USD 3m risk reversal vanilla strikes of 1.28 and 1.31.

At spot ref: 1.2450, on a technical perspective also, 1.31 should remain a strong horizontal resistance as 2009 low and the level rejected when the cable tried to bounce in mid-July.

The position is naturally long vega on the downside and short on the topside, fitting with the volatility market dynamics. Cable skew normalized too much Five weeks after the Brexit vote, the GBP volatility market normalized sharply.

Alternatively, we buy 3m risk reversals again that favors bearish sentiments since the GBPUSD’s implied volatility is perceived to be rising among the major currency counterparts (but 3m ATM contracts shrinking below 10.5% in recent times.

While the 3m-1y delta risk reversal indicates hedgers have been ready to pay high premiums on OTM puts in longer time horizon.

So relying on the OTC indications, one can execute the option strategy on hedging grounds as stated below:

It is advisable to construct option strips strategy so as to mitigate the risks associated with this pair. To execute this strategy, go long in 2 lots of 1w ATM -0.49 delta puts and simultaneously, short 1 lot of ATM +0.52 delta calls of similar expiry.

In the bottom line, Should the foreign trader reckons that the underlying volatility will likely remain significantly higher in the medium term, then this strategy is advisable, he may even wish to hold on to the long term straddle to profit from any large price movement that may occur.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts