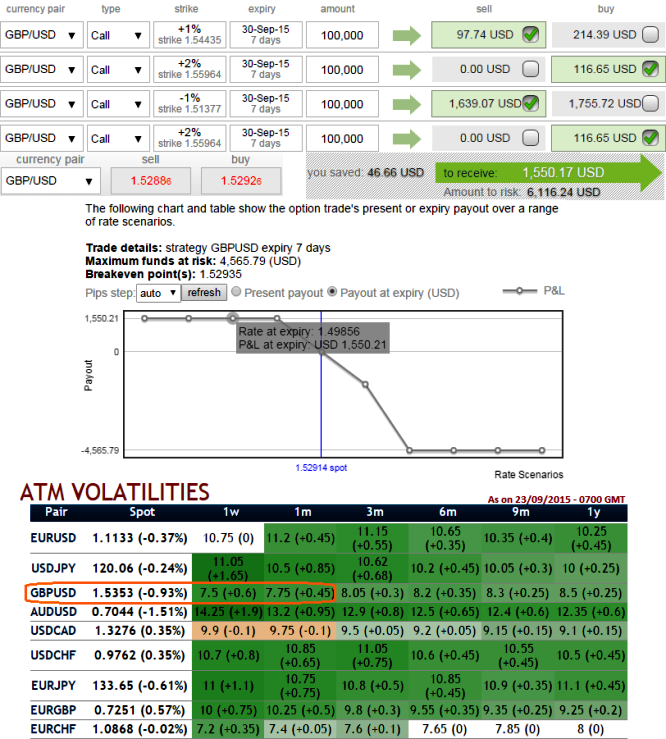

Since the cable's implied volatility is still perceived to be comparatively minimal within next one month time frame from other major G7 pairs (at around 7-8%), so here comes a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

As shown in the figure, the trader can implement this strategy using call options with similar maturities. The trader can construct a long condor option spread as follows ideally for the short call spreads to expire worthless. So strategy goes this way, writing an (-1%) In-The-Money call and buying deep striking (-1.5%) In-The-Money vega calls, writing a higher strike (1%) Out-The-Money calls and buying another deep striking (1.5%) Out-Of-The-Money vega call for a net debit. For demonstrated purpose we have used identical expiries but in live scenarios use the longer maturities on longs and shorter maturities on shorts.

Rationale: As there are no significant data releases that could propel GBP side for this week and near future GBPUSD may likely to experience low volatility. You can make out from the nutshell showing IV; GBPUSD is to have the least IV among G7 currency pool.