Apart from the FX market, the huge risk is associated with the weights of positions in spread product in the segment of fixed income, treasuries and in EM assets.

Longer-term flows of capital out of risk assets would usually be dollar-supportive but in the FX market, the big net position is still, clearly, long US dollars. Yield spreads continue to support the Euro as 10-year Treasury yields are anchored around 2.2%.

Yes, the market trend is much more a function of positions being taken off as the FOMC meeting gets underway.

Perhaps the combination of risk reduction and shedding of dollar longs built up ahead of the start of the rate hiking cycle is what has driven the dollar down relative to the yen after previous hikes.

What is clear today though, is that the short-term pre-FOMC risk is of a break higher in EUR/USD for no obvious reasons than positions reduction, and of USD/JPY drifting lower considering comments post Fed decisions, whether Yellen sends dovish or hawkish views, while GBPUSD has been struggling to hold onto the resistance levels at 1.52 regions from last 3 consecutive trading sessions for targeting 1.5025.

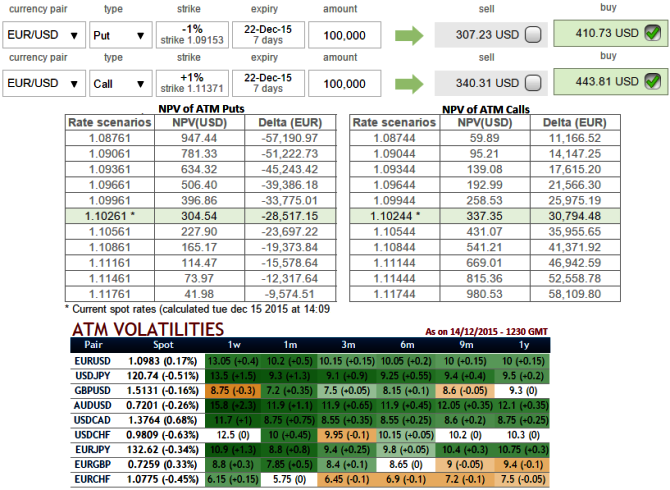

Hedging activity using OTC products have been expensive:

The cable's IVs of ATM contracts are still perceived to be the second least within next 1w-1m time frame among G7 space (at around 7-8%), you can observe implied volatilities from the diagram:

While GBPUSD Spot FX is at 1.5142,

The premiums of 1% OTM put are overpriced above 30% more than NPV while IV is likely to perceive at around 7-85 range.

While same has been the case with calls, the premiums of 1% OTM call is trading 30% more than NPV.

Thereby, we conclude stating much disparity exists between OTC sentiments and IVs.

FxWirePro: GBP/USD OTC markets overreact ahead of FOMC, treasuries and fixed income spreads eyeing on risk

Tuesday, December 15, 2015 9:31 AM UTC

Editor's Picks

- Market Data

Most Popular