Yes, cable has cleared all crucial support zones, although bearish trend is on but don't expect steep slumps.

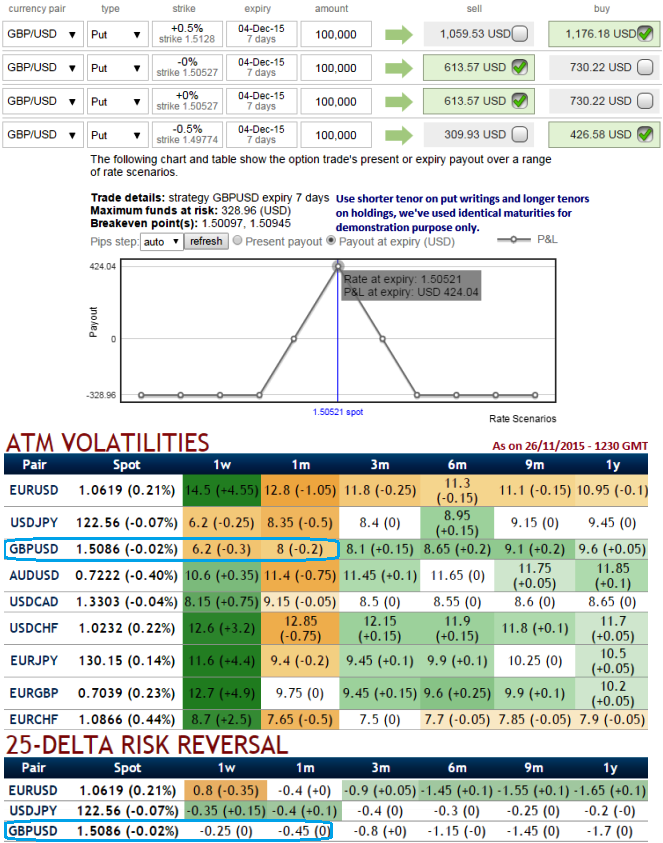

Since the cable's implied volatility is still perceived to be the least within next 1w-1m time frame from other major G7 pairs (at around 6-8%), we wouldn't see any dramatic fluctuation on the underlying pair.

So here comes a multiple leg of option strategy for regular traders of this currency cross when there is lower IV. A total of 4 legs are involved in the butterfly spreads strategy and a net debit is required to establish the position.

The trader can implement this strategy using put options now with similar maturities to deal with lower implied volatility.

Construct a butterfly spreads using puts as delta risk reversal has shifted market sentiments towards slightly downwards. One should use this when expectation the exchange price of the GBPUSD to change very little or within a very tight trading range over the life of the option contracts.

So strategy goes this way, writing 2 lots of 3D (-1%) at the money puts and buying (1%) out of the money -0.32 delta put and buying another (1%) in the money -0.66 delta put for a net debit.

The highest return for this strategy is attained when the GBPUSD price remains unchanged or nearby ATM strikes at expiration.

At this price, only the highest striking put expires in the money. On the flip side, maximum loss would be limited to the extent of initial debit paid to enter the trade plus brokerages.

Tenors expressed in the diagram are only for demonstration purpose, in live scenarios use the longer maturities on longs and shorter maturities on shorts.

FxWirePro: GBP/USD IVs least among G7 – execute butterfly spreads via puts

Friday, November 27, 2015 11:05 AM UTC

Editor's Picks

- Market Data

Most Popular