We update an analysis on sterling volatility as carried out, characterized by Labour/Conservative party conferences and UK/EU verbal tensions on the Brexit negotiations.

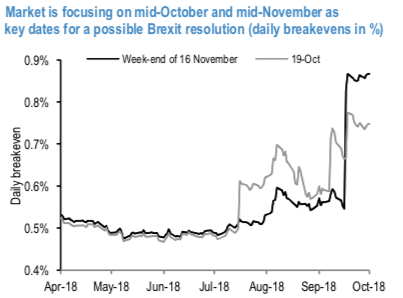

Well, a smooth and upward sloping cable curve indicates the lack of specific risk-events especially in the 3M-1Y segment (where the curve is remarkably flat). If ever, over the past few weeks market attention has increased for the 19 October (EU summit) and mid-November (refer 1stchart, showing the daily breakevens); while an emergency November EU summit hasn’t been announced yet (that would be conditional on substantial progresses in the negotiations to occur in October), markets are closely watching the weekend of 16 November.

While vols have been on the rise since September, they remain very contained compared to the 2016 highs (refer 2ndchart, for the 9M maturity): same conclusions are found for the so-called “vol of vol” parameter, which drives the convexity of the smile and the (implied) probability of fat-tail risk events to occur. The widening of risk-reversals in favour of GBP puts / USD calls (by around 1 vol) has been possibly more remarkable.

We reprise the analysis as carried out in the 12 September piece, assessing what the market is currently pricing for different scenarios, corresponding to probabilities (estimated in-house) of 60% for the EU-UK deal case vs. 20% each for no-deal and no-Brexit cases. With 9M cable- implied vol currently at 9.8%, we estimate the vol for the baseline scenario at 8.5% and that for the two risk-scenarios at 11.6% (up from the previous estimate at 11.2%). While the value of the high-vol mode is not low on a standalone basis and is higher than one month ago, a comparison with the patterns observed in 2016 around the Brexit referendum confirms the value of owning optionality for hedging non-core scenarios.

As discussed in the earlier piece, contained values of vol-of- vol parameters make OTM plain vanillas / exotic structures (vol/var swaps) good candidates for hedging large moves in cable. A low-cost alternative for hedging a much weaker cable is represented by 1*2 put ratio spreads (short 1x the higher strike, long 2x the lower strike). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is showing -146 (which is bearish), while USD is flashing at 143 (which is bullish), while articulating at (10:12 GMT). For more details on the index, please refer below weblink:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand