• GBP/NZD eased slightly on Monday but lacklustre PMI results and fiscal uncertainties in the UK capped gains.

• A survey showed Britain's manufacturers suffered a fresh setback in August with new orders dropping due to worries about trade tensions abroad and tax increases at home.

• The S&P Global/CIPS manufacturing Purchasing Managers' Index weakened for the first time in five months, decreasing to 47.0 from a six-month high 48.0 in July.

• Meanwhile,the UK calendar is relatively quiet, with retail sales as the main highlight. Bank of England officials Catherine Mann and Sarah Breeden are set to speak on Wednesday.

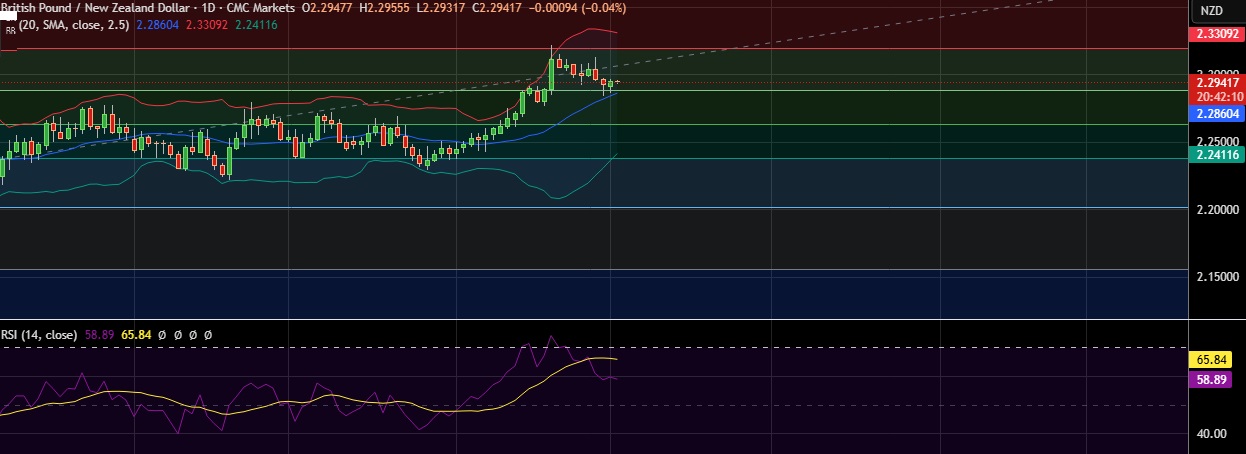

• Technical signals remain bullish, with RSI at 58 and the 5 , 9 , and 11 day moving averages all trending up.

• Immediate resistance is located at 2.0320 (23.6 fib), any close above will push the pair towards 2.3390 (Higher BB).

• Strong support is seen at 2.2869 (38.2% fib) and break below could take the pair towards 2.2632(50% fib).

Recommendation: Good to buy around 2.2900, with stop loss of 2.2760 and target price of 2.3100