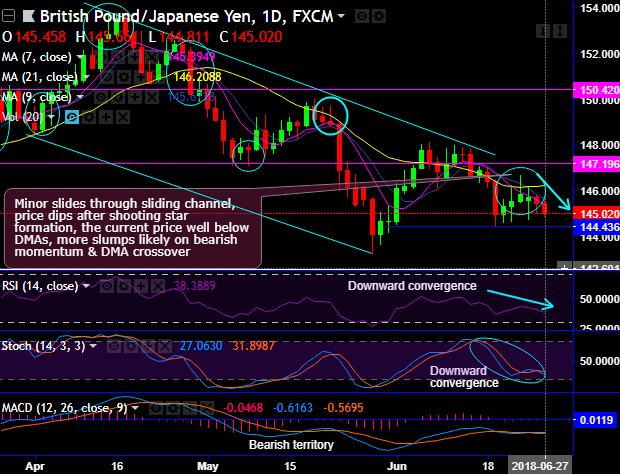

Chart and candlestick patterns occurred: shooting star has occurred at 145.818 levels, one can observe the bearish sentiments thereafter.

The price dips below 7DMAs ever since the occurrence of this bearish pattern (refer daily plotting), let's not forget we cannot afford to isolate this signal.

The above bearish pattern is coupled with leading oscillators and bearish DMA crossover.

While the intermediate trend so far was spiking through rising channel (refer weekly chart), but for now, bears have managed to breach below this channel support. In addition, back-to-back shooting star candles have occurred at 146.823 and 146.885 levels which are again bearish in nature and evidences considerable slumps below EMAs on this timeframe.

Consequently, both leading, as well as lagging indicators, have been signalling further price slumps to substantiate the above bearish patterns (refer weekly chart).

Ever since the occurrence of the breach below channel support, the price has been restrained below 21EMA (on weekly terms).

Both momentum oscillators (RSI & stochastic curves) have shown constant downward convergence on both timeframes that indicate the strength and the momentum in the bearish trend.

Trade tips:

On daily trading grounds, at spot reference: 145.001 levels, we advocate buying tunnel option spreads using 145.8961 as upper strikes and 144.436 as lower strikes. Tunnel spreads are the binary version of the debit put spreads, the strategy is likely to fetch positive yields as long as the underlying price keeps dipping but remains well above lower strikes on binary expiration.

Alternatively, one can initiate shorts in futures contracts of mid-month tenors with a view to arresting potential downside risks. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -54 (which is bearish), while hourly JPY spot index was at 124 (bullish) while articulating (at 09:23 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

The above indices are also conducive to the derivatives strategy as advocated above.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?