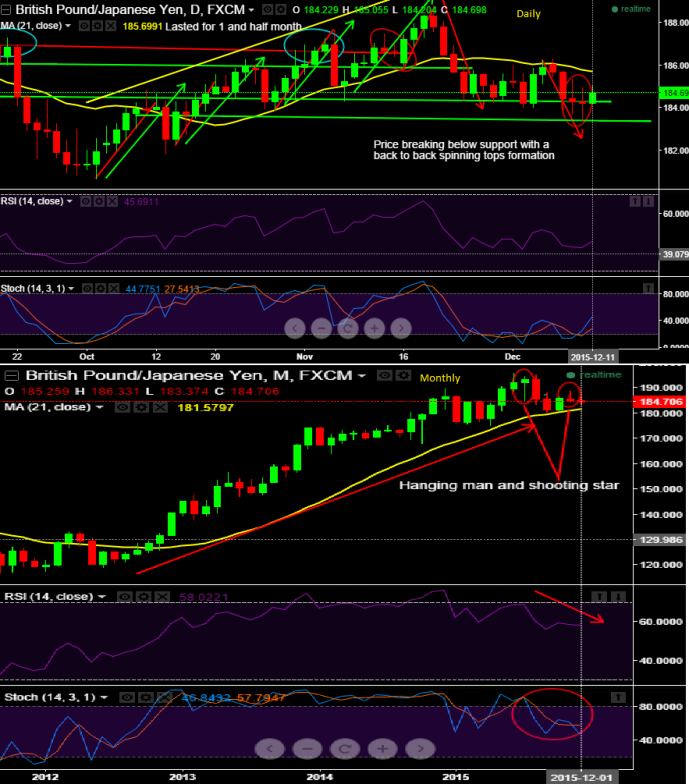

GBPJPY sends bearish message upon the formation of "back to back spinning top" pattern candles to break support at around 184.30 levels on daily chart.

No isolating analysis again..!! This signal, considering previous intermediate uptrend has reversed and sustained below 21DMA about more than 2 weeks.

Hanging man and shooting star patterns at 193.456 and 185.259 respectively on monthly charts are also figured out that vouch more declines.

We don't think bears should panic as minor upswings are likely every now and then. Now no room for misconception as we are not favoring these minor upswings in between.

There is no deviation at all and we've been firm to be bearish since September and would still carry the same stance on this pair.

For more reading please follow below link:

http://www.econotimes.com/FxWirePro-Hanging-man-confirmed-on-GBP-JPY-PRBS-for-long-term-hedging-86697

We reckon that the prevailing downswings would prolong for another two weeks times.

RSI's downward convergence and %D crossover above overbought territory is also spotted out which is suffice to indicate more selling pressures.

As stated earlier also it is important to emphasize that a hanging man and shooting stars candle patterns on monthly chart is a warning of potential price change, not a signal, in and of itself, to go short.

Overall pattern on the pair fixes it bearish set up for a target of 183.375 in short term and 177.125 to 175 levels in long terms.

FxWirePro: GBP/JPY in antagonistic intermediate trend – spinning tops break support, active bears target 183.375

Friday, December 11, 2015 6:09 AM UTC

Editor's Picks

- Market Data

Most Popular