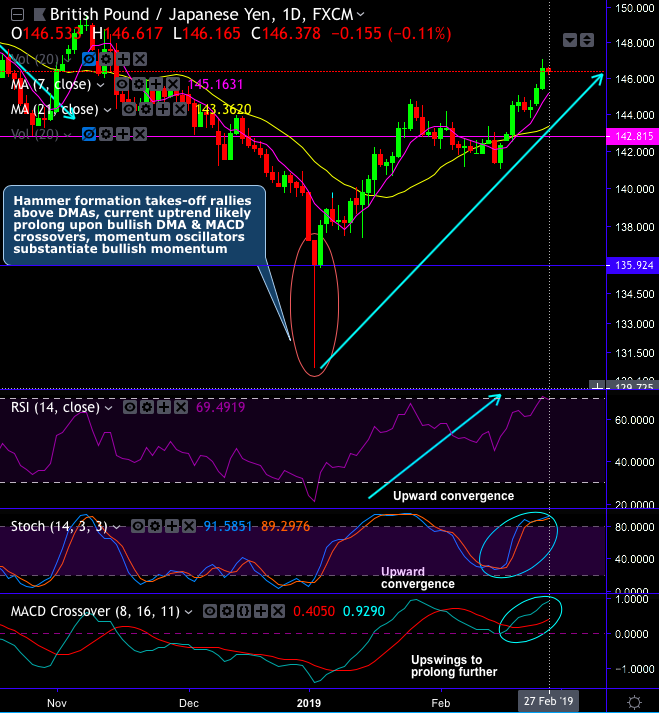

Technical analysis (chart and candlestick patterns occurred): On daily plotting, GBPJPY has been consolidating of-late. Consequently, last month, hammer pattern candlesticks have occurred at 135.992 and 142.689 levels on daily and monthly plotting respectively. Ever since the formation of hammer candle, the bulls take off rallies above DMAs, the current uptrend likely prolong upon bullish DMA and MACD crossovers, while momentum oscillators substantiate intensified bullish momentum.

On a broader perspective, the major downtrend that went in the consolidation phase has now continued bearish streaks again (refer monthly plotting), where the engulfing pattern has occurred at 146.754 and rail-road pattern at 144.165 levels on monthly terms to nudge prices below EMAs.

The major downtrend retraces 78.6% Fibonacci levels upon engulfing & rail-road patterns, hammer most likely to occur at 142.721 levels. Bulls counter on the hammer formation on this timeframe as well, both momentum indicators in line with the price dips. As a result, today’s trend has been attempting to slide further below 7SMAs.

Trade tips: At spot reference: 146.494, on daily trading grounds, contemplating above technical rationale, we advocate constructing double touch call option strategy, using upper strikes at 147.067. The strategy is likely to fetch leveraged yields as long as the underlying price keeps spiking on the expiration.

Alternatively, we advocate initiating shorts in GBPJPY futures contracts of Feb’19 delivery as further upside risks are foreseen and simultaneously, shorts in futures of Mar’19 delivery for the major downtrend. Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 150 (which is bullish), while hourly JPY spot index was at 88 (bullish) while articulating (at 08:24 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex