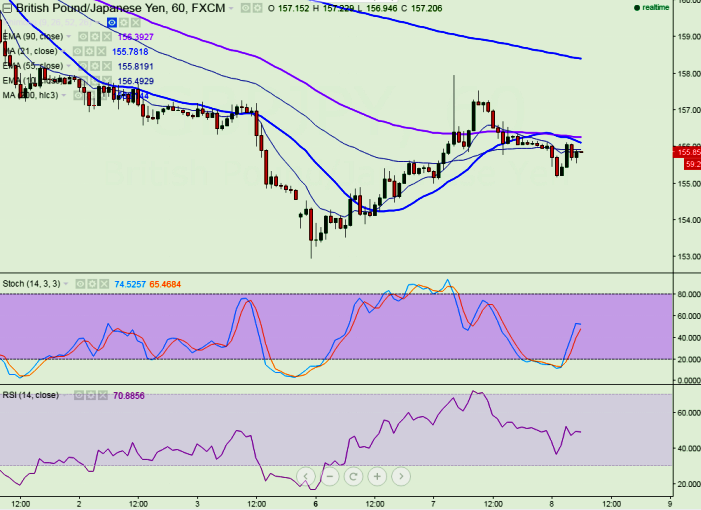

- Major resistance – 156.60 (Hourly Kijun-Sen)

- Major support – 155 (Cloud bottom)

- The pair has once again retreated after making a high of 157.55.GBP/JPY is weak as long as resistance 158 holds. Short term bullishness can be seen only above 158.

- The intraday resistance is around 156.60 and any break above targets 157.25/158.On the lower side 155 is acting as major support and any violation below that level will drag the pair down till 154.40/153.50 (88.6% retracement of 152.95 and 157.95).

- Markets await UK industrial and manufacturing which is to be released 08:30 GMT today for further direction.

It is good to sell on rallies around 156.50 with SL around 158 for the TP of 155.05/153.60