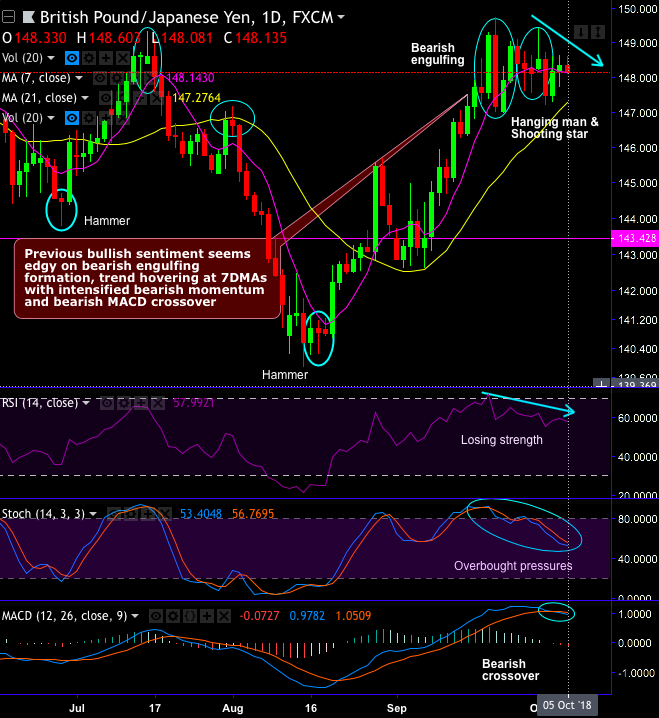

GBPJPY chart and candlestick patterns occurred: Bearish engulfing, shooting star and hanging man patterns have occurred to counter the previous bullish trend.

Engulfing patterns which are bearish nature have occurred on both daily and monthly terms at 147.151 and 146.754 levels respectively, one can observe the selling sentiments ever since then.

Yesterday’s price rallies have gone sideways today, while bears are hovering at 7 and 21-DMAs, let’s not forget we cannot afford to isolate this signal.

The above bearish patterns are coupled with leading oscillators and bearish MACD crossover.

Both momentum oscillators (RSI & stochastic curves) have shown constant downward convergence on both timeframes that indicate the strength and the momentum in the bearish trend.

Trade tips:

On daily trading grounds, at spot reference: 148.225 levels, we advocate buying boundary binary strategy, using upper strikes at 148.859 and lower strikes at 147.649 levels. The strategy is likely to fetch leveraged yields as long as the underlying price remains between above strikes on the expiration.

Alternatively, one can initiate shorts in futures contracts of mid-month tenors with a view to arresting potential downside risks. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 60 (which is bullish), while hourly JPY spot index was at 158 (highly bullish) while articulating (at 06:17 GMT). For more details on the index, please refer below weblink: