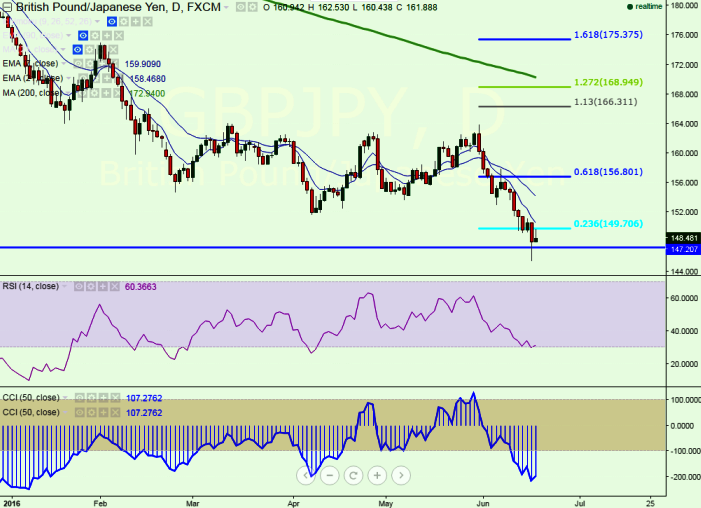

- Major resistance- 150.50 (5 DMA)

- Major support – 145

- The pair has jumped after making a low of 145.38. GBP/JPY has risen till 149.78 at the time of writing and slightly declined from that level.

- It should atleast break above 150.50 for further bullishness. Any indicative break above 150.50 will take the pair till 151.36 (7 day EMA)/152.40/154.78(21 day EMA.

- The pair must break above 21 day EMA for further jump till 158.

- On the lower side, a break below 146.80 will drag the pair till 145.88/145/144.20.

It is good to sell on rallies around 152.25-152.50 with SL around 155 for the TP of 148/146.50