Following on from last week’s ‘hawkish’ comments from Bank of England policymakers in the recent past, we now expect a UK rate hike of 0.25% to be announced after the next Monetary Policy Committee meeting on November 2nd. The minutes of the September meeting and subsequent comments by MPC members suggest that there is now widespread support on the committee for a rise.

The Japanese yen fell modestly possibly due in part to expectations of a snap general election.

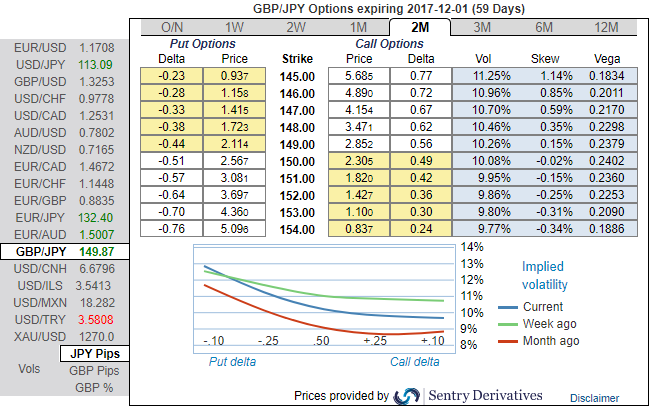

In addition, please be noted that the positively skewed IVs of GBPJPY of 2m tenors signify the hedgers’ interests in the bid for OTM put strikes at 145. While IVs of these tenors are spiking above 10.11% which is highest among G7 currency space, 2w IVs are on lower side comparatively.

In usual circumstances, long option position needs higher IVs for significant change in Vega as the shift in this Option Greek is highly sensitive towards implied vols. Hence, we capitalize on buzzing IVs and improve odds on options below strategy.

On the flip side, using shrinking IVs of shorter tenors with bearish neutral delta risk reversal is interpreted as an opportunity for writing OTM puts or theta shorts in short run on time decay advantage.

With this interpretation, one can judge whether the options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good.

Thus, we advocate weighing up above aspects as we eye on loading up with fresh vega longs for long-term hedging, more number of longs comprising of ATM instruments and OTM shorts with narrowed tenors would optimize the strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

Further GBPJPY upswings and/or abrupt weakness suggest building a directional strategies and volatility patterns at the same time.

Contemplating IV skewness and ongoing technical uptrend in the consolidation phase, we foresee the value of OTM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -41 levels (bearish), while hourly JPY spot index was at shy above -46 (bearish) at 05:46 GMT, these indies values are also in sync with our above technical rationale. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness