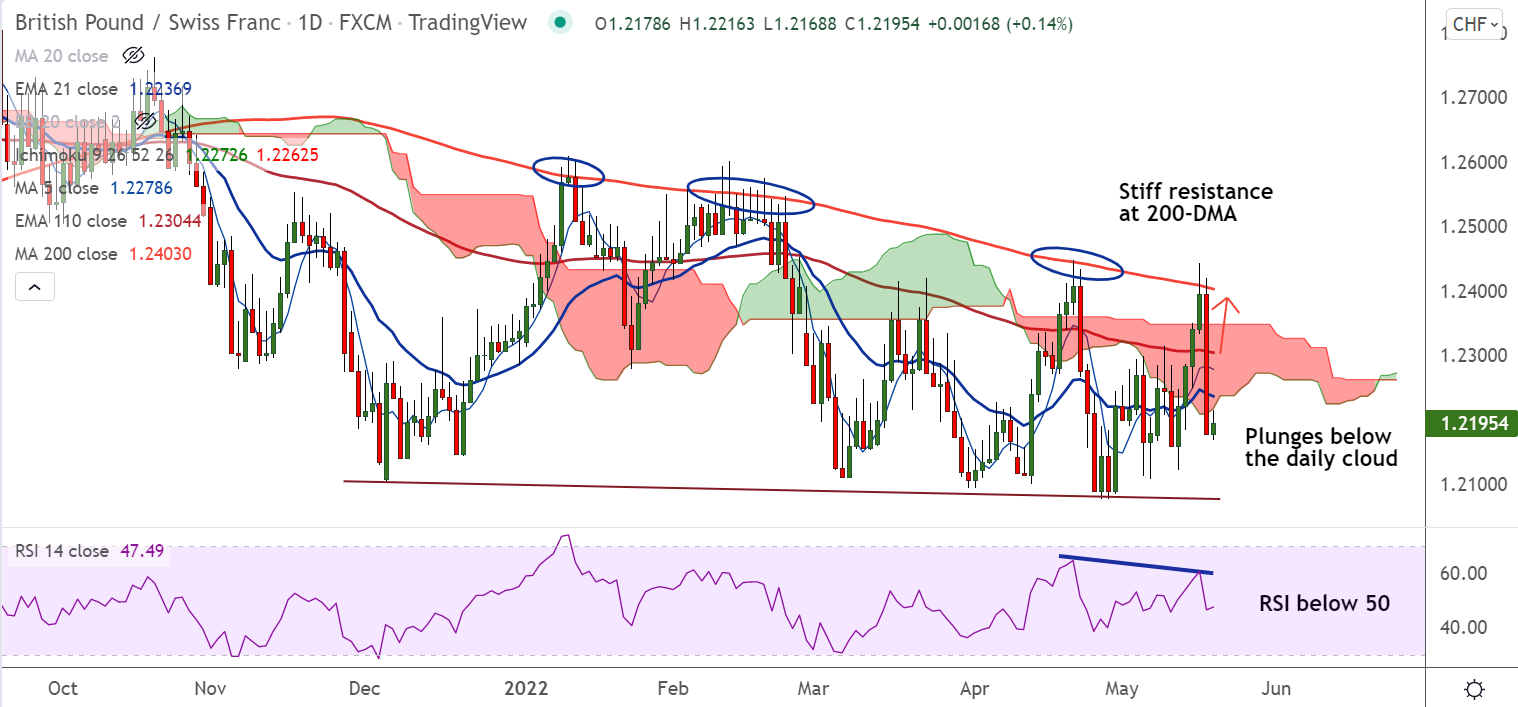

Chart - Courtesy Trading View

GBP/CHF plunged 1.75% and closed at 1.21786 from session highs at 1.24196, more downside likely.

The pair was trading 0.11% higher on the day at 1.21916 as price action consolidates previous session's losses.

The Swiss franc bulls are strengthens across the board after the testimony of Swiss National Bank (SNB) Chairman Chris Jordan on Wednesday.

Jordan said that the Swiss franc (CHF) is a safe-haven asset and continuation of a negative monetary policy is necessary to justify the inflation parameter.

He added that the targeted inflation figure at 2% has been well maintained and any temporary rise above the targeted figure will be diluted quickly by SNB intervention.

GBP/CHF was technically rejected at 200-DMA and the pair has broken below the daily cloud. Scope for test of major trendline support at 1.2075.