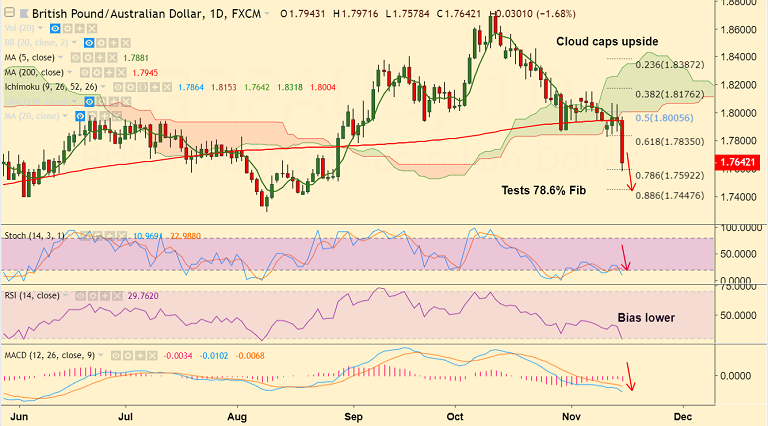

GBP/AUD chart on Trading View used for analysis

- GBP/AUD trades 1.63% lower on the day, tests 78.6% Fib at 1.7592, bias lower.

- Sharp sell off hitting the Sterling triggered by resignations in May’s Cabinet.

- Some members of PM May’s Cabinet resigned amidst a generalized opinion against the recently announced draft deal.

- UK Retail Sales came in below expectations for the month of October, further denting the pound.

- Data released earlier today showed UK retail sales contracted at a monthly 0.5% and expanding 2.2% YoY. Core sales dropped 0.4% m/m and rose at an annualized 2.7%.

- On the otherside, stellar Australia jobs data supports Aussie, weighing further on the pair.

- Momentum studies are bearish, pair is below cloud and major moving averages.

- Break below 78.6% Fib to see further weakness. Scope for test of 1.7282 (Aug 9 lows). Bearish invalidation only above 200-DMA.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025