Targeting volatility via optimal portfolios:

An aggressive trader or investor keen on the volatile asset class targets a rise or fall measured in volatility points.

However, the Markowitz framework can be used to design optimal allocations which correspond to the volatility change targeted by the investor.

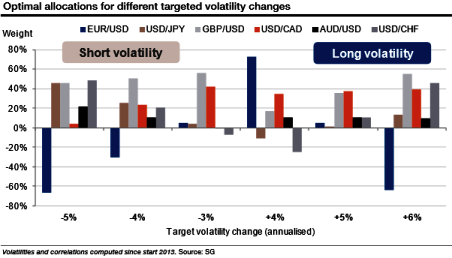

The main observations on the six optimal allocations obtained with the data sample since the start of 2013 follow below (see graph):

AUD/USD volatility generally has a small weight while the EUR/USD and GBP/USD tend to have large absolute weights.

All allocations (buying and selling volatility) are buying GBP/USD and USD/CAD volatility.

Long volatility portfolios are underweighted in USD/JPY volatility.

Targeting either a large rise or fall involves massively selling EUR/USD volatility and buying the five others.

The biggest long USD/JPY volatility exposure is found to target a large volatility fall.

The corresponding portfolio will be efficient in the sense that it will be diversified and exposed to the minimal level of risk given the targeted return. In that way, the expected return becomes an exogenous input.

Obtaining the optimal allocations equates to a slide on the efficient frontier. We compute the optimal allocations corresponding to targeted volatility increases and falls. The order of magnitude of these investing scenarios corresponds to the historical scenarios.

The numbers reflect the usual asymmetry with volatility increasing more than it falls (the return of the naive allocation is a gain of 4.9 points in the rising case, whereas the falling case sees a gain of only 4 points).

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data