The US Fed left policy unchanged yesterday evening, as expected, but the accompanying statement did express more concern about the recent softness in prices. The FOMC statement seems to have been the trigger rather than the cause of this new leg of USD weakness. The reasons for the current USD weakness really do rest with the Fed. It is really impressive how a central bank has managed to destroy itself in less than 10 years.

Considering the recent shifts in the balance between interest rates and politics, USDJPY targets are projected; now we target 110 as of end-September (previously 108), 107 as of the end-year and end-March 2018 (105 respectively) and 105 as of the end-June 2018 (103).

However, we still expect USDJPY to track a modest downward trend in mid-to long-term. This is because:

1) Although relevant political risks mentioned above have not materialized yet, they have not disappeared and

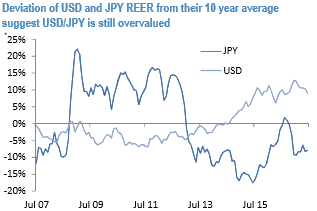

2) We believe that the current level of USDJPY is overvalued; in REER terms, USD’s overvaluation and JPY’s undervaluation are significant (refer above chart).

Also, according to JPM’s long-term fair value model which uses terms-of-trades, productivity differences etc. as explanatory valuables, the current USDJPY fair value is at 101.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -26 levels (which is mildly bearish), while hourly JPY spot index was at shy above -64 (bearish) at the time of articulating (at 08:24 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data