The recent JPY appreciation has already brought USDJPY below our year-end target (108). What is puzzling us is that correlations between USDJPY and the Nikkei/yield gap have been extraordinarily unstable. While the JPY appreciation started due to de-risking in global stock markets, the JPY appreciation has not lost a momentum though the stock markets have stabilized already.

Meanwhile, a positive correlation between USDJPY and the yield gap recovered only temporarily; however, they no longer seem to have the correlation.

The positive correlation between USDJPY and the Nikkei index has collapsed or remarkably unstable since last fall. We have listed possible drivers of such developments: a positive correlation between TOPIX EPS and USDJPY has weakened due to improving earnings of domestic demand-oriented industries.

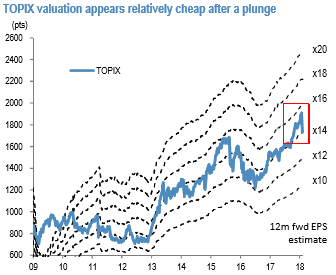

Also, possibly foreign investors have started buying Japanese stocks without FX hedge based on the recognition that JPY is at the historically cheap level in real terms. Note that after a sharp decline in TOPIX, the current PE ratio is around 14 times (refer 1st chart).

The valuation appears relatively cheap and this might motivate foreign investors to start buying Japanese stocks, buying JPY.

With regard to the collapse of correlation between USDJPY and US-Japan yield gap, except a brief recovery of the positive correlation around end Jan/early-Feb, the correlation has collapsed significantly since early this year. USD has been negatively correlated with US long-term yields since end-2017.

Arguably investors have sold US Treasuries and the sales have resulted in USD sell-off. Separately, it is worth noting that JPY and US interest rates have been positively correlated though they tend to move to opposite directions (refer 2nd chart). While reasons for the new relationship are unclear, it could be understood to be Japanese investors who hold US Treasuries and have no FX hedge engaging in cutting losses ahead of FY-end. Indeed, Japanese lately net-sold foreign bonds. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index has shown -77 (which is bearish), while hourly JPY spot index was at 12 (neutral) while articulating at 09:42 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close