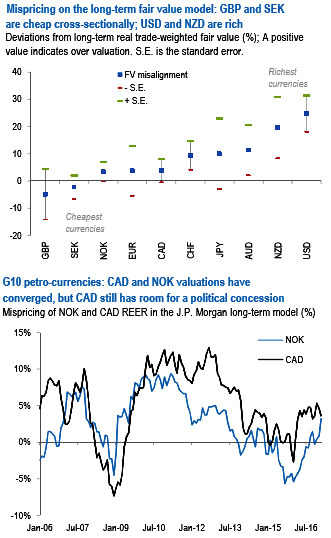

There is scope for more concession for political risk in European currencies. EUR still screens near fair value on this framework, indicating that there is room for further weakening if political risks intensify heading into the French elections. The richness in EUR continues to be similar to that in CHF on this framework, a gap we think should widen in favor of Swiss franc.

The dollar has strengthened across the board over the past month, keeping it as the richest currency on this framework. The outperformance of the dollar has come primarily at the expense of commodity currencies, but the overall ranking of these currencies hasn’t changed much in response. NZD and AUD continue to screen the richest on this framework, while the petrol currencies (NOK and CAD) are closer to fair value (refer above chart).

Scandis continue to offer value relative to most of the G10. SEK is still the second cheapest currency on this framework despite the outperformance over the month. NOK is modestly above fair value but still the third cheapest cross-sectionally and the cheapest within the G10 commodity currencies spectrum. NOK has richened modestly relative to CAD and are currently mispriced by a similar magnitude, which continues to indicate that there is a little NAFTA-related political concession in CAD (refer above chart).

Trades:

Long a 3-mo EURNOK 9.07 - 9.75 range binary, Short a 2-month 9.10 EUR put/SEK call, while short NZDSEK via vanilla puts.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields