Markets have mostly converged on a June hike, but the medium-term path remains discounted relative to our and the Fed’s expectations.

We recommend adding conditional exposure to mean reversion via 3Mx10Y 1x2 payer spreads

On the policy front, this leaves us firmly on track for the FOMC to lift rates at their June meeting. Markets are in broad agreement, with the front-end forwards currently pricing in roughly 90% likelihood of a hike — mostly in line with cyclicals around well-telegraphed moves.

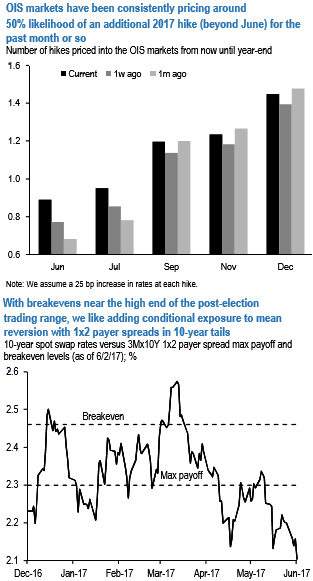

Further out, however, markets remain skeptical the Fed will be able to raise rates again in 2017: December meeting OIS rates, for example, have been consistently pricing around 50% likelihood of a second hike by year-end for the past month or so (refer above diagram).

This is consistent with the experience of the past few years, during which the Fed’s focus on data dependency has guided markets to focus on the near term while discounting the potential for acceleration in the pace of tightening.

Further out in maturity, however, markets are retesting the low end of their post-election trading range. As our Treasury strategists note, all else equal the path of least resistance is some degree of mean reversion, and we are tactically bearish on duration. However, we believe demand is robust at modestly higher rate levels, which combined with a lack of progress on fiscal policy and broader signs of gridlock in D.C. point to relatively low odds of breaking out to the high end, or even re-testing the previous peaking rate.

Further, a number of potential exogenous shocks — either domestic or geopolitical — raise the risk of a rally. This argues for adding conditional exposure to mean reversion via 1x2 payer spreads. For intermediate tails in particular, spot rates at the low end of the range with breakevens near the previous highs in some structures are strong arguments in favor (refer above diagram). Therefore, we recommend buying 3Mx10Y 1x2 payer spreads.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary