The announcement of the British Prime Minister Theresa May to invoke the British exit request in line with article 50 by March 2017 at the latest, thus starting official exit negotiations put considerable pressure on Sterling yesterday.

As a result, Cable kept tumbling from the highs of 1.3120 after the release of the above significant data, you are seeing that the pound slumped to a multi-years low (31-year lows) against the dollar (spot quote at 1.2745) today on concerns over the timing of Britain's planned exit from the European Union, according to traders.

EURGBP rose to a new post announcement high of just shy below 0.8765, GBPJPY is just about keeping steady at 130.712 levels.

What is causing particular uncertainty among investors class are the strong affirmations of the British government to insist on limiting the freedom of movement.

This increases fears of a “hard” Brexit because so far nobody sees a possibility of achieving this without May having to accept notable restrictions when it comes to accessing the single market.

That in turn, is likely to lead to considerable economic effects and be of notable relevance for the attractiveness of GBP investments. Until an amicable agreement can be reached in this matter Sterling will, therefore, remain under pressure.

Hedging Framework:

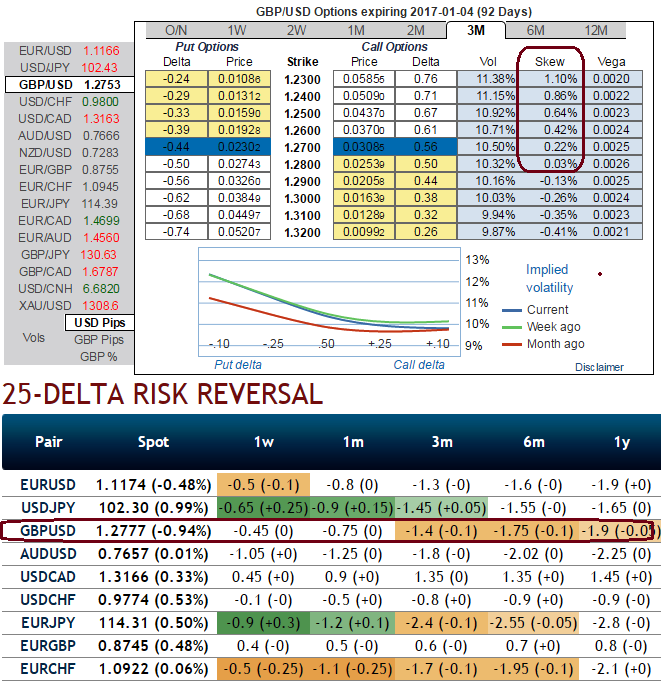

Since the GBPUSD’s implied volatility is perceived to be rising among the major currency counterparts (3m ATM contracts spiking above 11%).

While the 3m delta risk reversal indicates hedgers have been ready to pay high premiums on OTM puts in longer time horizon.

So relying on this IV and risk reversal indications, one can execute the option strategies as stated follows:

We buy 3m risk reversals that favour mild bearish sentiments, it is advisable to construct option strips strategy so as to mitigate the risks associated with this pair.

To execute this strategy, go long in 2 lots of 1w ATM -0.49 delta puts and simultaneously, short 1 lot of ATM +0.52 delta calls of similar expiry.

In the bottom line, Should the foreign trader reckons that the underlying volatility will likely remain significantly higher in the medium term, then this strategy is advisable, he may even wish to hold on to the long term straddle to profit from any large price movement that may occur.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed