The 6th round of the NAFTA negotiations comes to an end in Montreal today. While CAD traders had so far paid little attention to the progress of the negotiations this is likely to have changed following the last meeting of the Bank of Canada (BoC).

By now everyone is likely to have realized that the future of NAFTA would not only have an enormous effect on the Canadian economic outlook but that even the continued uncertainty of the matter might affect the BoC’s rate hike path.

An uncertainty that might continue for some time yet - according to a report, industry representatives and people close to the negotiations assume that the negotiations might be extended beyond the current deadline of 31st March maybe even into the next year. In Montreal, no significant progress has been made on any of the critical issues.

We expect more details from the statement at the end of this negotiation round. We assume that CAD will react much more sensitively to NAFTA headlines than it did in the past.

Hence, ahead of uncertainty NAFTA and trade tensions. Accordingly, MXN is anticipated to strengthen to 18.40 with improvement in NAFTA sentiment.

Meanwhile, option pricing suggests a decent build-up of event risk premium in MXN vols: 2W MXN ATM vols @13.4 have rallied to their highest levels since before the start of negotiations last summer, and CAD 2W ATM is 1.5vols above 2017 levels. Current O/N vols are indicating a fairly punchy 1.5-1.7% spot move breakeven for USDMXN and 1.0% for CAD over the Jan 24-26 period.

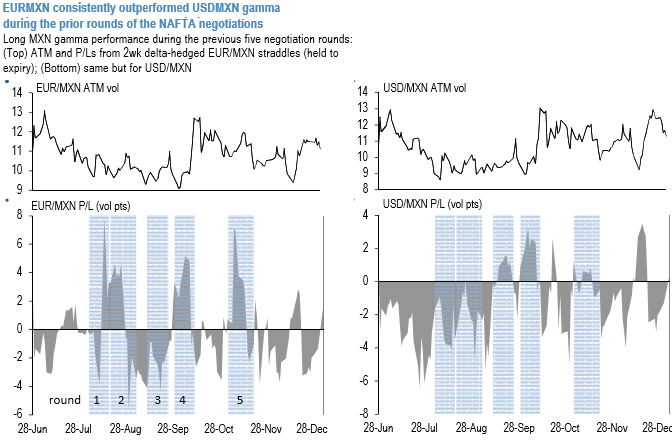

An analysis of MXN gamma performance during the five previous rounds of negotiations (refer above chart) shows that EURMXN tends to consistently outperform USDMXN around these events, perhaps because the more liquid and closely watched USD-vol has tended to attract the bulk of the hedging flows. EURMXN 2w straddles exhibited significant positive returns around two rounds of talks, modest gains in two others and losses during only one round.

While this limited sample analysis indicates a strong positive skew to gamma returns, ex-post event P/Ls have been heavily conditioned on favorable ex-ante vol pricing.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data