Today, USDCNY mid-point fix was set just slightly lower at 6.9098 and is holding steady around 6.9300. The Chinese fiscal policy may need to remain expansionary to offset any tightening in credit conditions that may arise from the regulatory changes. This brings us to the currency. The potential regulatory changes are yet another source of uncertainty for overall conditions and where PBoC would like to take it. In the end, stability is probably the best option for now.

The long SGD and THB FX positions have been squared-off against the USD over the past ten days on the assumption of an adverse US-China trade conflict. We, though, continue to shy away from being short these currencies or for that matter KRW and TWD given the starting point of current account balances and valuations. CNY FX is different to these other currencies in that it does not enjoy the aforementioned supportive factors any longer. In an adverse trade war, CNY will likely bear a part of the policy adjustment.

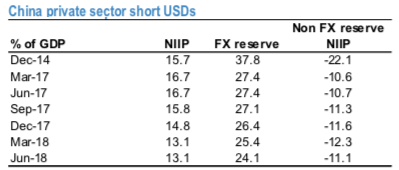

A bounded trade expression: Accordingly, a paid 3x6 CNH forward position is activated (180 pips vs 3mth outright at 315pips). The private sector is short USDs even though some of the imbalances moderated in 2Q’18 (refer above chart) and higher capital outflows could cause forward points to rise as has been the experience in 2015 and late 2016 / early 2017. Our trade expression is a bounded one and not an outright short CNY one because every base-line scenario carries a tail risk and there is always a possibility that the trade tensions moderate in intensity or are spread over time. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CNY spot index is flashing at -42 (which is bearish), while hourly USD spot index was at -78 (bearish) at 13:13 GMT. For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes