The prevalent lockdown of large swathes of the Eurozone economy to contain the spread of Covid-19 resulted in a sharp plunge in the ‘flash’ PMI survey for March, with services activity in particular falling more sharply than forecast. The overall composite PMI, which combines manufacturing and services output, dropped to 31.4 from 51.6, exceeding the global financial crisis low in 2009. According to IHS Markit, the outturn is “indicative of GDP slumping at a quarterly rate of around 2%, and clearly there’s scope for the downturn to intensify further”. As the chart shows (in the pdf), actual GDP contracted in 2009 by more than the survey indicated.

The headline manufacturing PMI index fell to 44.8 from 49.2, which was a smaller decline than expected. Nevertheless, the decline mainly reflected big falls in output and orders. Both the German and French manufacturing PMIs fell sharply to 45.7 and 42.9, respectively. We don’t yet have figures for other Eurozone countries, but it’s likely that the drop in Italy was much bigger. The fall in the services PMI was unprecedented, surpassing even the lowest economist forecast. It dived to only 28.4 from 52.6, reflecting the hit to industries such as travel, tourism and restaurants. German services PMI dropped to 34.5, while the French outturn collapsed to 29.0.

These survey results highlight the urgency with which monetary and fiscal policies need to be implemented to support the Eurozone economy. The ECB has already announced a substantial upscaling of its net asset purchases this year and more favourable terms for liquidity provided to banks. President Lagarde has pledged “no limits” to the ECB’s commitment to the euro. The euro has risen above $1.08. German 10‑year bund yields traded below intraday highs at ‑0.36%.

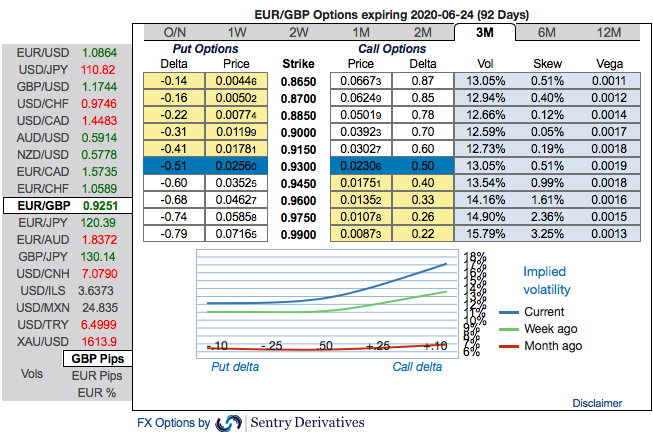

Our defensive stance in EURGBP has been dictated by the receding global economic tide, but we cannot ignore that political risk has been an instrumental factor in these worse macro outturns. This warrants a tactical reduction in our defensive exposure but we uphold our hedging portfolios via 3-way straddles.

Let’s just quickly glance at OTC updates & suitable options strategy:

The positively skewed IVs of 3m tenors are well-balanced, indicating both upside and downside risks, more bids are observed for OTM call strikes up to 0.99 levels.

While EURGBP risk reversals of the existing bullish setup remain intact as fresh bids for bullish risks have been added across all tenors.

Below options strategy could be deployed amid the expected turbulent conditions. According to the OTC FX surface, 3-way options straddle versus ITM puts seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of buying at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM put option of 2w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentry, Saxo & Lloyds

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields