Euro area GDP increased 1.4% QoQ, SAAR in Q3’16, very close to the PMI’s signal.

This raises the signaling value of the large PMI increase in October, pointing to some upside risk in Q4’16.

In the final report for October, the Euro area composite PMI was revised down 0.4pt to 53.3, which still left it 0.7pt higher than in September. The revision was mostly in services and in the periphery, although the former still rose in the month while the latter was stable at a solid level. Overall, the PMI’s message is positive. At the composite level, new orders rose only slightly (+0.1pt to 52.9).

Euro area unemployment fell and core inflation remained low.

Bank lending continued to hover at historical lows.

As occurred in the US before the Treasury taper tantrum in 2013, ECB QE has created a valuation and positioning problem that biases the euro to appreciate on even subtle changes in ECB policy.

German exports surged in August (see above nutshell evidencing external payments), having fallen significantly in July, due to holiday distortions. In September, we expect some payback, although the underlying trend should remain solid, in line with the recent strength in the business surveys.

FX Option Trade Tips:

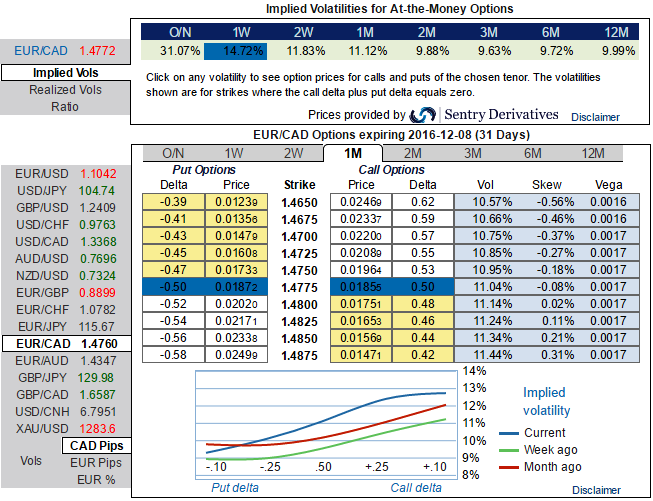

1m ATM IVs of EURCAD are spiking above 11.12%, and likely to shrink from the current 30% to the 14 and odd pct in 1w tenor which is conducive for the option writer. While you can also observe the positively skewed IVs towards OTM calls that explains the hedgers upside risk averse sentiments.

Hence, at spot ref: 1.4757 (while articulating) we advocate below FX derivatives strategy as we favor optionality to the directional trades. After a series of bearish streaks in October, we are now inclined to position for a partial retracement of the upmove through call spreads, as calling it as the bottom out with a dragon fly doji pattern and as adding directional spot exposure is risky at the moment.

Thus, using any abrupt dips, you decide to initiate a diagonal debit/bull call spread (DDCS) at net debit.

The execution: Initiate shorts in 2W (1.5%) out the money calls with positive theta, simultaneously, buy 1M in the money 0.51 delta call option. Establish this option strategy if EURCAD is either foreseen to be in sideways or spike up considerably over the next month but certainly not beyond your upper strikes in short run.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis