ETHUSD recovered sharply after a major sell-off. It hit a low of $3022 at the time of writing and is currently trading at around $3025.

The entire crypto market showed a major sell-off on Friday after a weak US Nonfarm payroll and an increase of rates by BOJ. As per coinshares, ETH ETF showed an inflow of 49 million on Monday.

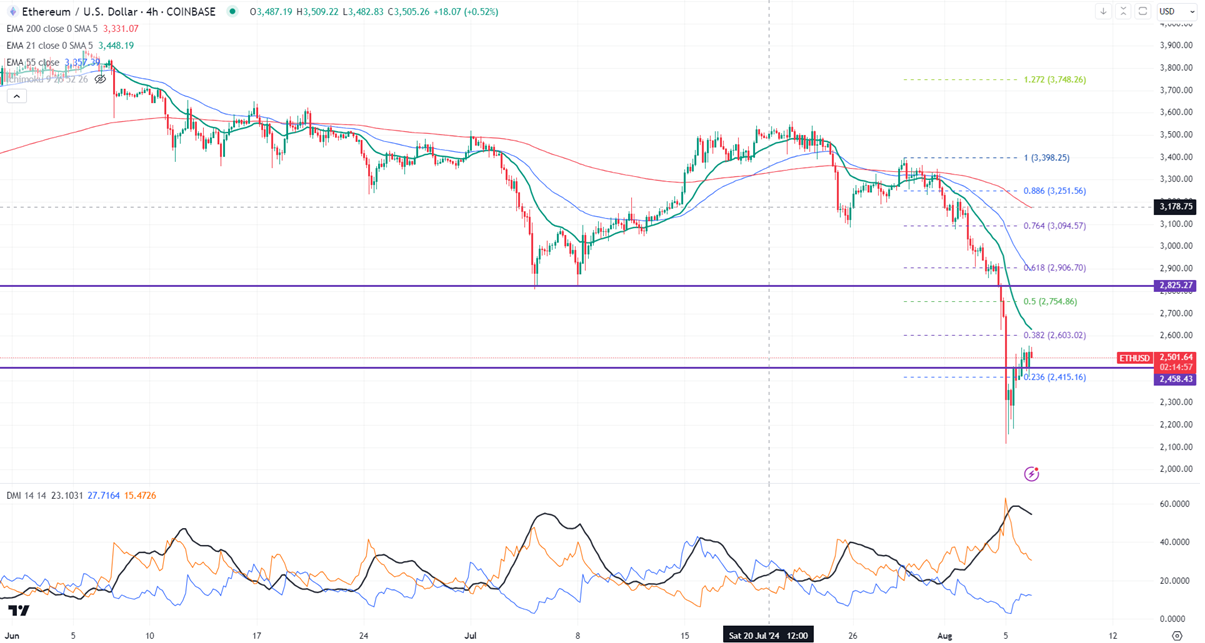

The intraday bullishness is possible if it holds above $2600.On the higher side, the near-term resistance is 2603. Any significant jump above the target is $2800 (support turned into resistance)/$3000. Significant bullish continuation only above $3400.

The immediate support is around $2100. Any breach below $2350 confirms bearish continuation. A dip to $2300/$2100/$1800/$1500 is possible. A violation below $1500 will drag the Ethereum to $1000.

It is good to buy on dips around $2300 with SL around $2100 for TP of $2800/$3000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary