With less than 100 days to go to the highly contested US election, investor focus around the event risk pricing has intensified. A record of sorts, the 2020 US election started receiving attention more than a year early. The pricing settled into a range, albeit a wide one, defining the lower bound in May/June following the first signs of the COVID-19 normalization.

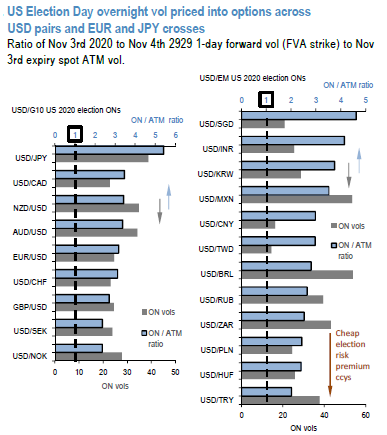

It is difficult to analytically judge rich/cheap in option pricing of event risks, especially for one-off/ infrequent ones like elections with few priors, so any judgments on this front are impressions more than anything else. An earlier study looked into 1M tenor fwd vols starting 1-week before election dates and extracted a rough a rule of thumb which states that the ratio of 1M FVA / ATM vols at 1.4 - 1.5X is a common threshold that leads to positive returns from fading steep forward vols. USDJPY at 1.43X is the lone currency pair already at the threshold and amid the recent focus on the US/China relationship, we find JPY/KRW at 1.38, USDCNH at 1.35 and USDSGD at 1.32 as the next most elevated vols, though still below the 1.4X threshold. We dive into a more traditional screen of event risk pricing via overnights / ATM vol ratio metrics in 1st chart. The ONs reinforce the earlier notion of the USDJPY (5.5X ONs/ATM ratio) and JPY/KRW (5X in ONs/ATM ratio) pricing being quite extended. Finding the Asia EM alongside JPY as being the highest priced is no surprise to us. We find it interesting that EMEA ONs are priced lightly among the USD pairs, EUR and also JPY crosses. With the political noise decibels around Russia having potential to increase, one would expect the RUB ONs to be reflecting at least some of that risk but the 1M FVA/ATM ratio at 1.05X indicates a near complete complacency. Trying to explain away that complacency via elevated RUB base vols does not hold as RUB base vols are on par if not even cheap to the EM vols, e.g. 6M USDRUB ATM vols vs 6M VXYEM (JPMVEM6M). As in the past with the defensive CNH fwd vol US election exposure that we own, our preference is for vol calendars spanning 1M window or more, in order to mitigate the offsetting effects from long gamma and event vols roll-off.

While delays in getting the results are atypical for the US elections, the fluid COVID-19 backdrop and reliance to a larger degree than in the past on mail-in voting carries some risks which wider spanning calendars would be effective in hedging. Taking USDJPY vols as an illustrative example in 2nd chart we note that USDJPY implied 1M fwd vols are showing a typical cliff-edge post-election roll-off on order of 3vol pts (from 10.5 down to 7.5vols).

Meanwhile, the assumption of a post-election calm contrasts somewhat the observed realized post-election vol from the three of the relatively recent US elections (2000, 2004 and 2016). 2008 election was deemed too skewed by the GFC to be of any use for this analysis. Again, we believe the sample is far too small for drawing any accurate conclusions and the dynamics of each of the election cycle was heavily influenced by the idiosyncratic drivers, but it is clear to us that one cannot count on FX markets promptly calming in the aftermath of such major events. The analysis speaks in favor of owning vols that contain the post-election period. RUB vols check all the boxes though may require executing via delta-hedged straddles calendars which carry the inconvenience of re-striking. With the USDRUB - AUDUSD fwd vols spread back to near the historical low, we see value in the RV that spans the election and post-election exposure.

Consider: Long USDRUB 2M2M FVA @13.9/14.9 vs short AUDUSD 2M2M FVA @10.65/11.25. Courtesy: JPM

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different