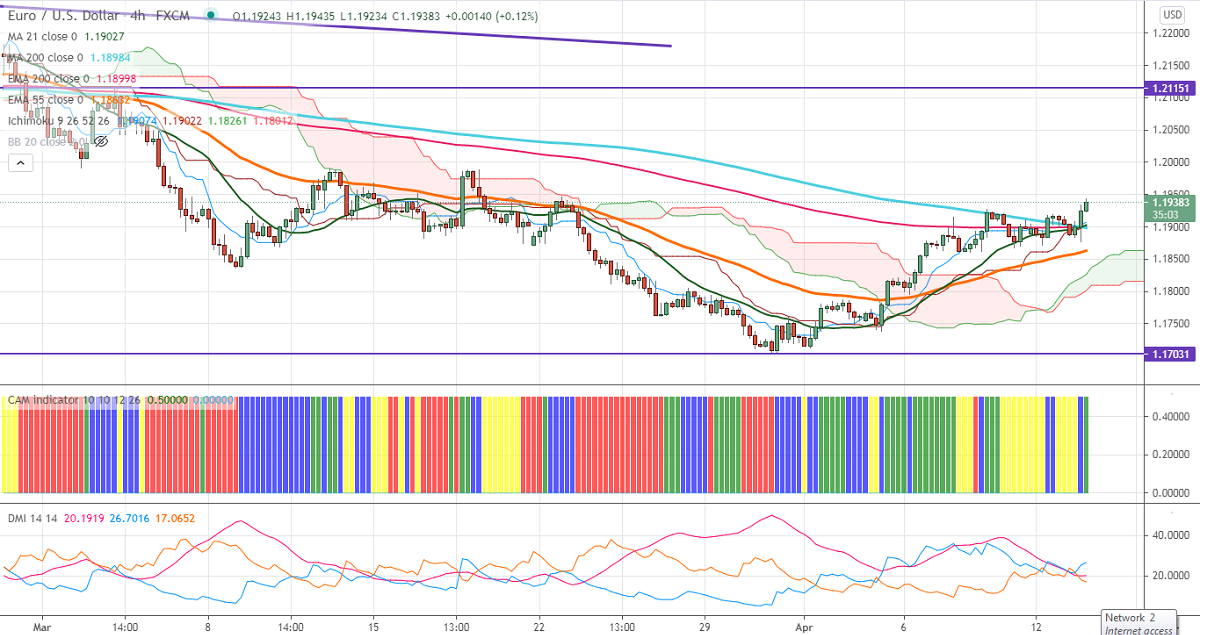

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.19028

Kijun-Sen- 1.18975

EURUSD has recovered sharply after US Consumer price index data. US CPI rose 0.6% in Mar compared to a forecast of 0.5%. The yearly inflation rose to 2.6% highest levels since the fall of 2018. The US10- year yield declined more than 2.5% on upbeat inflation data. The US FDA has halted the use of Johnson and Johnson coronavirus due to blood clot issues weighing on the US dollar.

DXY is trading below 92 levels, markets eye 91.80 for further bearishness. EURUSD hits an intraday high of 1.19400 and is currently trading around 1.19071.

Technical:

The pair is facing strong support at 1.18600. Any break below confirms minor bearishness, a dip till 1.1800/1.1770 likely. The near-term resistance is around 1.1950. An indicative breach above will take the pair to next level till 1.2000/1.2048. Short-term trend reversal only above 1.2000.

Indicator (4 Hour chart)

CAM indicator –Slightly bullish

Directional movement index – Bullish

It is good to buy on dips around 1.1920 with SL around 1.1870 for the TP of 1.2048.