FxWirePro- EURUSD Daily Outlook

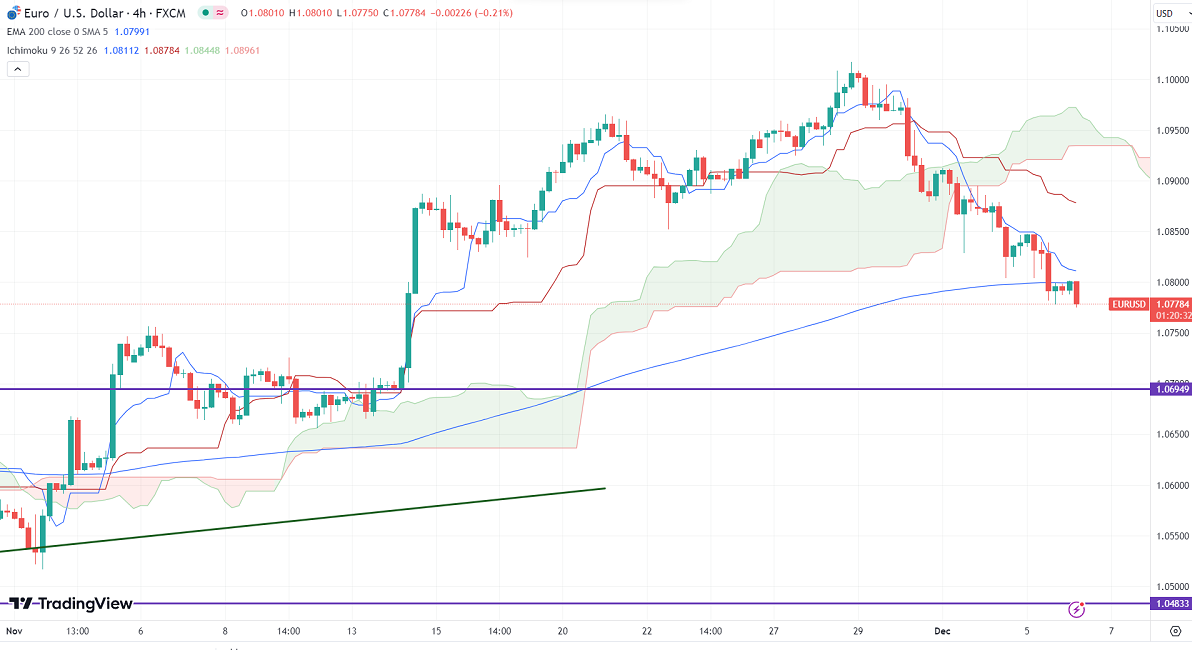

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.08128

Kijun-Sen- 1.08807

EURUSD has been trading lower on board-based US dollar buying for the past five days. It hit a low of 1.07781 and is currently trading around 1.07835.

Major economic data for the day

Dec 6th, 2023, ADP employment change (1:15 pm GMT)

US ISM services PMI rose to 52.70 in November, compared to a forecast of 52. The final services Eurozone PMI showed a slight jump to 48.70. Hawkish comments from ECB member Schnabel support the euro at lower levels.

According to the CME Fed watch tool, the probability of a no-rate hike in Dec increased to 99.70% from 99% a day ago.

The US 10-year yield trades weak despite strong US ISM services PMI. The US 10 and 2-year spread widened to -41% from -14.50%.

The pair trades below short-term 21 EMA, above 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any break below 1.0760 confirms further bearishness. A decline to 1.0700/1.0660 is possible. The near-term resistance is around 1.0865 and any breach above targets is 1.0900/1.0965. Bullish invalidation only if it breaks below 1.0440.

Indicator (4-hour chart)

CCI – bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.0848-850 with SL around 1.0900 for a TP of 1.0765.