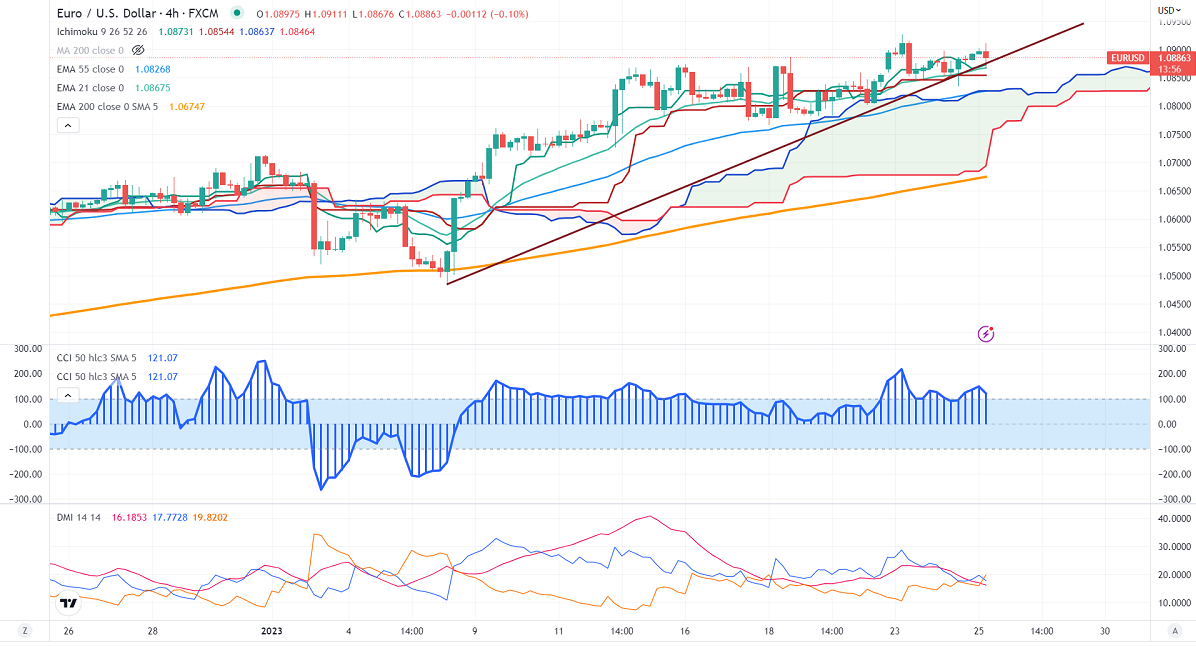

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.08689

Kijun-Sen- 1.08544

EURUSD trades weak despite good German IFO data. It came at 90.2 in Jan versus the previous reading of 88.60, in line with the estimate of 90.20. The chance of a higher rate hike by the ECB increased sharply after ECB policymaker Gediminas Simkus reiterated that the central bank should continue to hike rates by 50 bpbs in the next two meetings. It hits an intraday low of 1.08676 and is currently trading around 1.08884.

US flash manufacturing and services PMI came at 46.6 and 46.8 respectively, above the estimate.

Technical:

The pair is trading above short-term (21 and 55 EMA) and long-term (200-EMA) in the 4-hour chart. Any break above 1.0950 confirms bullishness, a jump till 1.100/1.0650 likely. The near-term support is around 1.0860. The breach below will drag the pair down to 1.0820/1.0760/1.0700/1.0660/1.0600.

Indicator (4-hour chart)

CCI – Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.0865 with SL around 1.08250 for the TP of 1.100/1.1060.