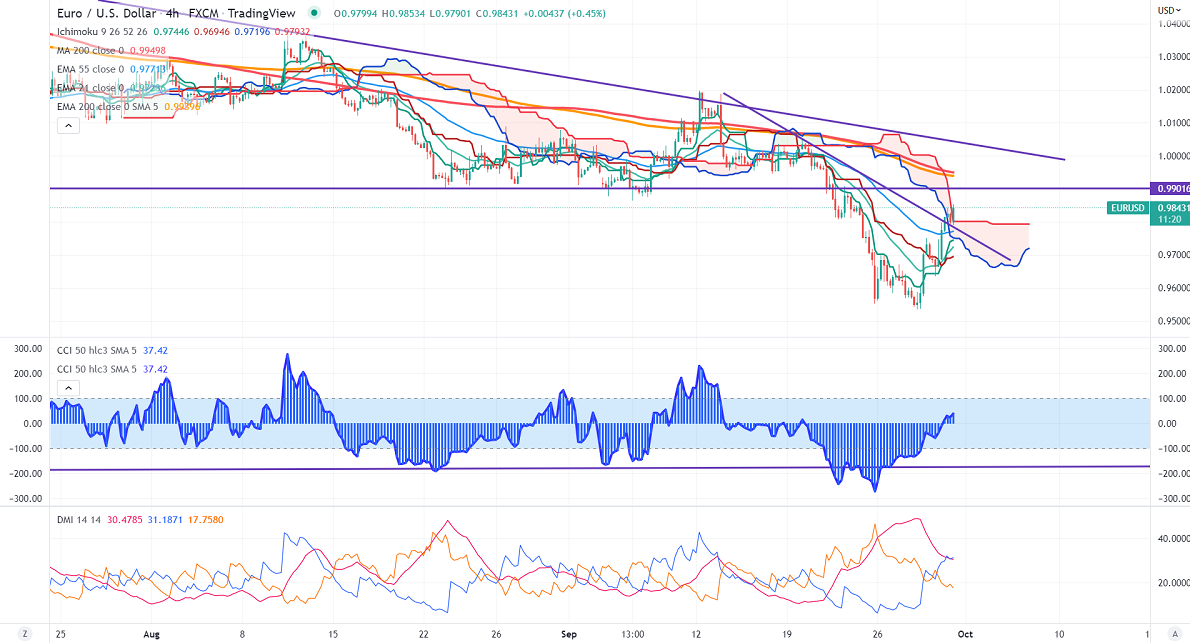

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.98910

Kijun-Sen- 0.99287

EURUSD trades higher for the second consecutive day and jumped more than 300 pips on short covering. US dollar index was one of the best performers this month and surged 600 pips on a hawkish rate hike by Fed. The central bank hiked rates by 75 bpbs for the third consecutive time to tackle inflation. The blast in US treasury yields also supports the US dollar at lower levels.

The number of people who have filed for unemployment benefits dropped by 16000 to 193000 the previous week, the lowest level in five months.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Nov declined to 56.1% from 72.9% a week ago.

EURUSD hits a high of 0.98534 and is currently trading around 0.98363.

Technical:

On the higher side, near-term resistance is around 0.9925 and any convincing breach above will drag the pair to the next level of 0.9965/1.00500/1.0200.

The pair's immediate support is at 0.9800, breaking below targets of 0.9740/0.9700.

Indicator (4-hour chart)

Directional movement index – Neutral

It is good to buy on dips around 0.9800 with SL around 0.9740 for TP of 0.9950.