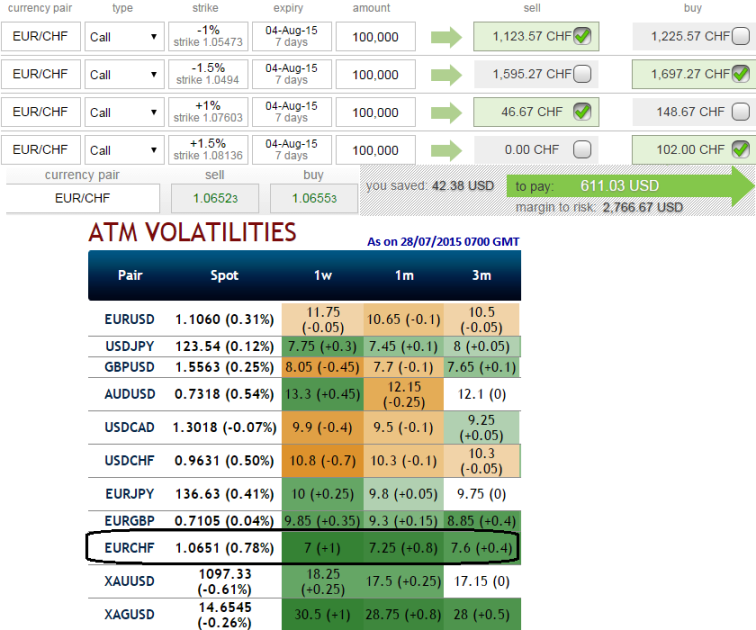

As anticipated in our earlier post, near future EURCHF pair likely to experience low volatility. You can make out from the nutshell; EURCHF is to have the least IV.

Currency option strategy through Condor Spreads: EURCHF

We predict marginal downswings on daily charts with downward converging signals from RSI (14) and %D line crossover on stochastic curves above 80 levels which is over overbought zone. Although there is no trace of drastic or dramatic movements on either side we still sense some sort of downward momentum.

Off-late, Swiss has produced an upbeat trade surplus numbers on the flip side. The healthy Swiss trade balance has printed at 3.58 billion which is a way beyond market analysts' projections at 2.72 billion and from previous flash at 3.41 billion.

Since the EURCHF's implied volatility is perceived to be minimal, so here comes a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

The trader can construct a long condor option spread as follows, as shown in the figure; the trader can implement this strategy using call options with similar maturities. So strategy goes this way, writing an In-The-Money call and buying deep striking in-the-money call, writing a higher strike OTM calls and buying another deep striking out-of-the-money call for a net debit.

FxWirePro: EURCHF condor spreads best suitable for low IV

Tuesday, July 28, 2015 7:38 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary