It is unlikely to regard EURO's sustainably higher until there is real domestically generated inflation.

Headline inflation has been dragged down by energy prices but even core inflation is soft (particularly in Spain/other periphery countries).

Services inflation appears to have troughed but is yet to trend higher (services are 43.5% of consumption basket and depend more on domestic factors/wage pressures).

Eventually we think EUR recovers but it will be slow. However, these speculations have left the forecasts unchanged in this month (EUR/USD 1.03 end-Q1 and parity by end-Q2).

Hence, EURO could be boosted temporarily by risk aversion in its role as risk off proxy or more sustainably by signs of inflationary pressures.

Hedging Frameworks:

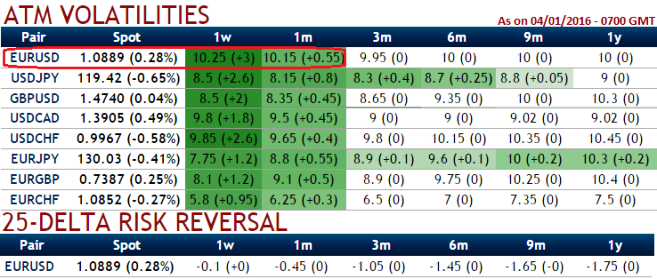

As you can observe from the table showing implied volatilities of ATM contracts (EURUSD of 1W-1M expiries show 10.25% and 10.15% that is the highest among G10 majors).

So, by employing the Vega options can not only multiply the returns but also upbeat the implied volatility.

Any spikes in this pair in near term can be attributed as shorting opportunity in our back spreads.

As shown in the diagram, contemplating the above risk reversal computations, we construct strategy comprising of both ITM as well as ATM puts in the ratio of 2:1 so as to suit the swings on either directions.

Capitalizing on higher IV and negligible risk reversals in short run, we can eye on shorting (0.5%) 3D in the money put that would lock in certain yields by initial receipts of premiums.

Thereafter, 2 lots of 1m ATM -0.48 delta puts with vega 124.62 are preferred to suit the prevailing losing streaks, thereby the spread would be executed for net debit and the cost is reduced by short side.

FxWirePro: EUR/USD tops IVs among G10, deploy vega puts in diagonal back spreads for tight hedging

Monday, January 4, 2016 1:22 PM UTC

Editor's Picks

- Market Data

Most Popular