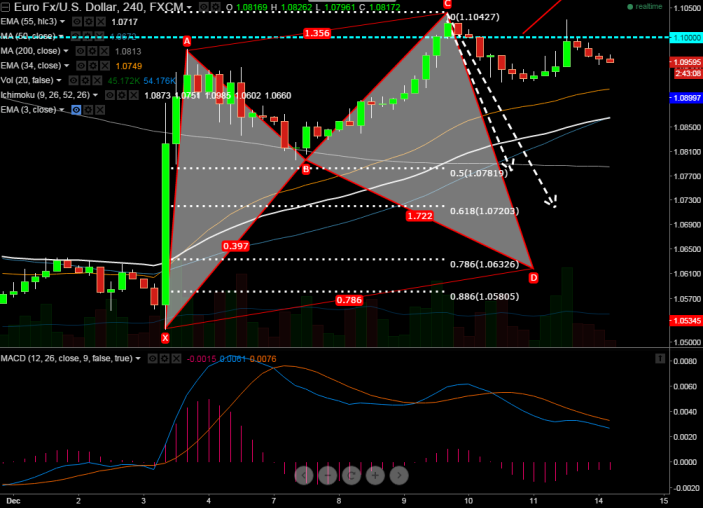

- Harmonic Pattern- Bullish Cypher Pattern

- Potential reversal Zone (PRZ) -1.10500

- The bullish cypher pattern becomes invalid only if it breaks above 1.10450.

- The pair has made a high of 1.10305 and declined from that level. Overall trend is still weak as long as resistance 1.10450 holds. Any break above 1.10450 will take the pair till 1.1070/1.1090 level.

- The market awaits highly anticipated FOMC meeting on Dec 16th. Fed is expected to hike interest rates by 25bpbs to 0.50%.

- On the lower side major support is around 1.0900 and break below will drag the pair further down till 1.0830/1.07850 level.

It is good to sell on rallies around 1.09850-1.0990 with SL around 1.1050 for the TP of 1.0900/1.0830.